Every month, find out all about the sustainable market bonds news in our newsletter "MySustainableCorner".

This month in a nutshell

- NEPI Rockcastle, the first owner and operator of shopping centers in Central and Eastern Europe, recently issued a green bond to improve the energy efficiency and the use of renewable energies for its real estate assets. As of today, the group’s overall assets are mainly made of green buildings with high levels of environmental certifications.

- The contraction of sustainability-linked bonds (SLBs) continues in 2024, with €24 bn issued to date, representing less than half of the amount raised during the same period in 2023. This decline is largely attributed to investors' ongoing attention regarding the credibility of these issuances: significant uncertainties remain concerning the assessment of the ambitions tied to the objectives associated with these transactions and the materiality of this structure.

- In a world where diversity is increasingly recognized as a potential driver of performance, what real impact would gender indicators have on the stability and profitability of companies? According to Bloomberg, the main benefit of gender diversity indicators, such as the presence of women on boards, appears to lie in reducing volatility rather than improving returns.

- The Deputy Governor of the Bank of England stated that easing the regulatory framework in the UK could boost the country's economic growth, particularly by stimulating investments in water-related projects and infrastructure, green technologies, and energy—key sectors in the UK's sustainability agenda (Sarah Breeden).

- The United Kingdom has closed its last coal-fired power station, becoming the first G7 member (which also includes Italy, Canada, France, Germany, Japan, and the United States) to reach this milestone.

Figure of the month

tCO2 avoided per €M invested in bonds complying with European standards on EuGBS green bonds, compared to green bonds not aligned with this standard

Source: Main Street Partners, June 2024. EuGBS: EU Green Bond Standards

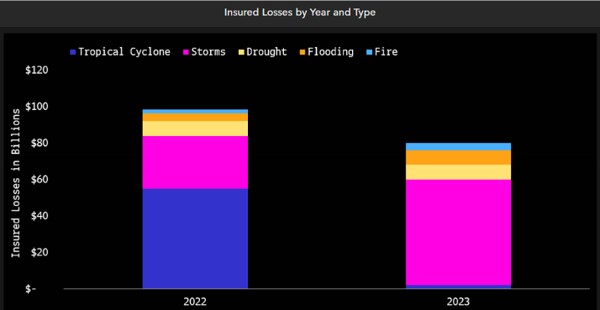

Chart of the month

Impact of climate disruptions on home insurance premiums

In the United States, climate disruptions are leading to an increase in home insurance premiums: increase of 21% in 2023 and a potential 24% increase for 2024 in California.

Source: Bloomberg