Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum AM's views on the economy, strategy and markets.

The cio letter

The Red Swan

Donald Trump is indeed the expected source of volatility for markets. Tariff announcements, sometimes reversed almost immediately, hit the wires and additional measures—potentially targeting Europe or Japan—are likely to emerge in the coming weeks. This volatility may persist, yet the markets seem to be coping for now. The upcoming elections in Germany, which are subject to American influence, will be crucial in revitalizing an economy that has languished for the past two years. Meanwhile, China has opted not to negotiate with Trump, instead implementing a targeted response alongside its technological advancements. More "red swans," such as DeepSeek, should be anticipated.

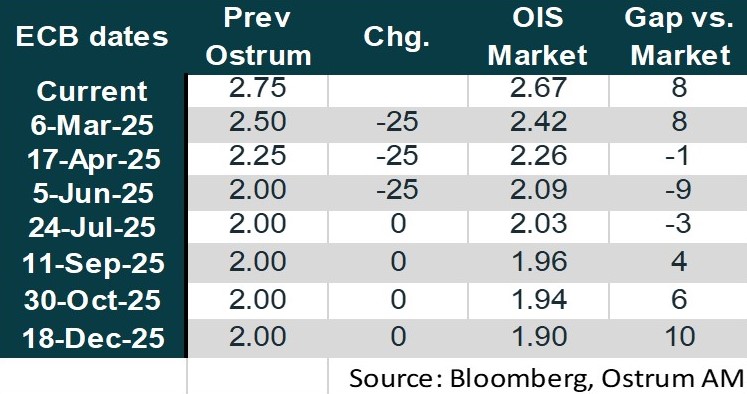

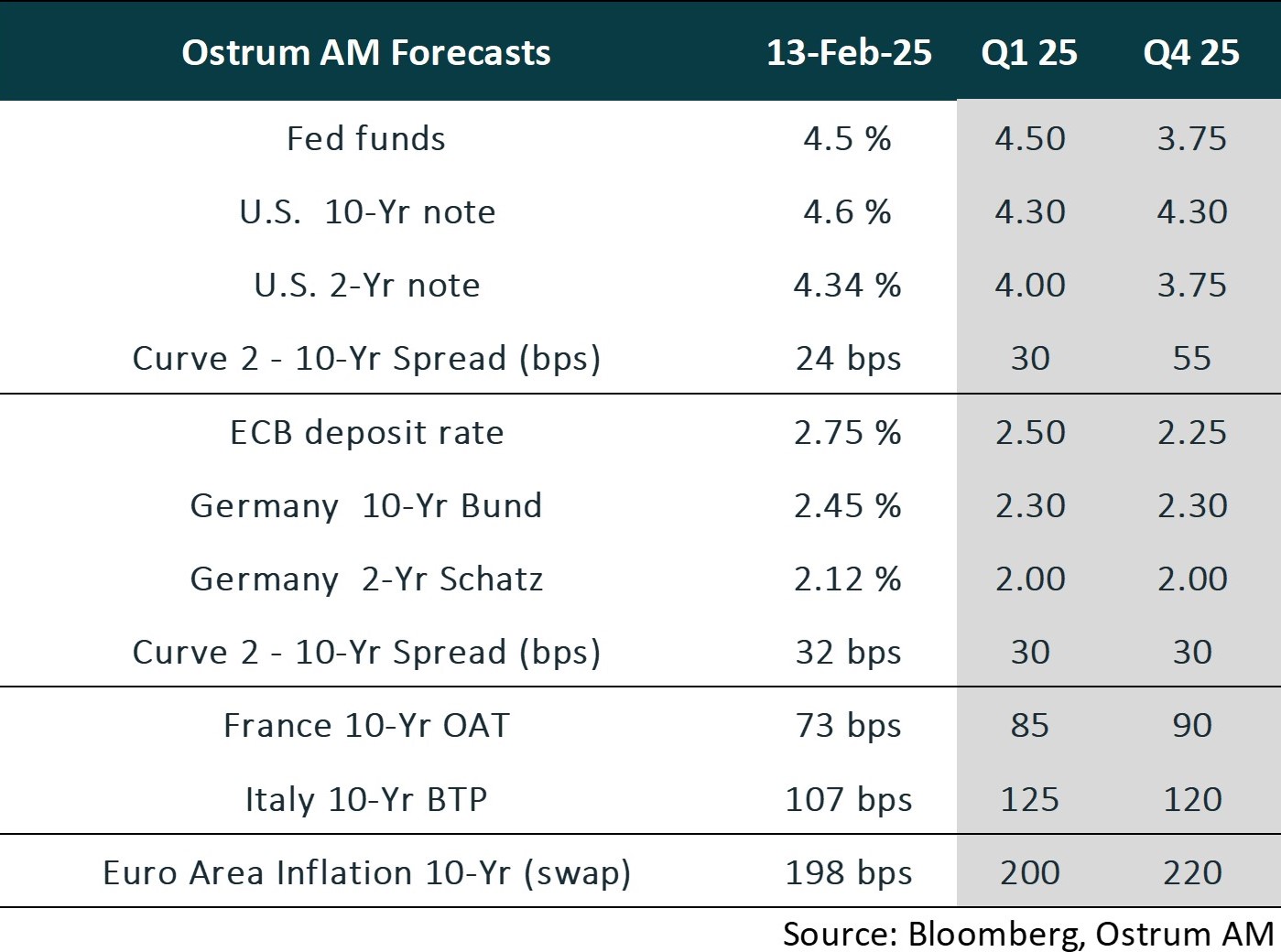

The Federal Reserve is now expected to maintain status quo as it assesses the policies of the new administration, particularly their inflationary implications. This cautious stance from the Fed contrasts sharply with the proactive approach of the ECB, which, despite inflation running above target, is expected to cut the deposit rate to 2% by June. The BoJ will continue its trajectory of rate hikes.

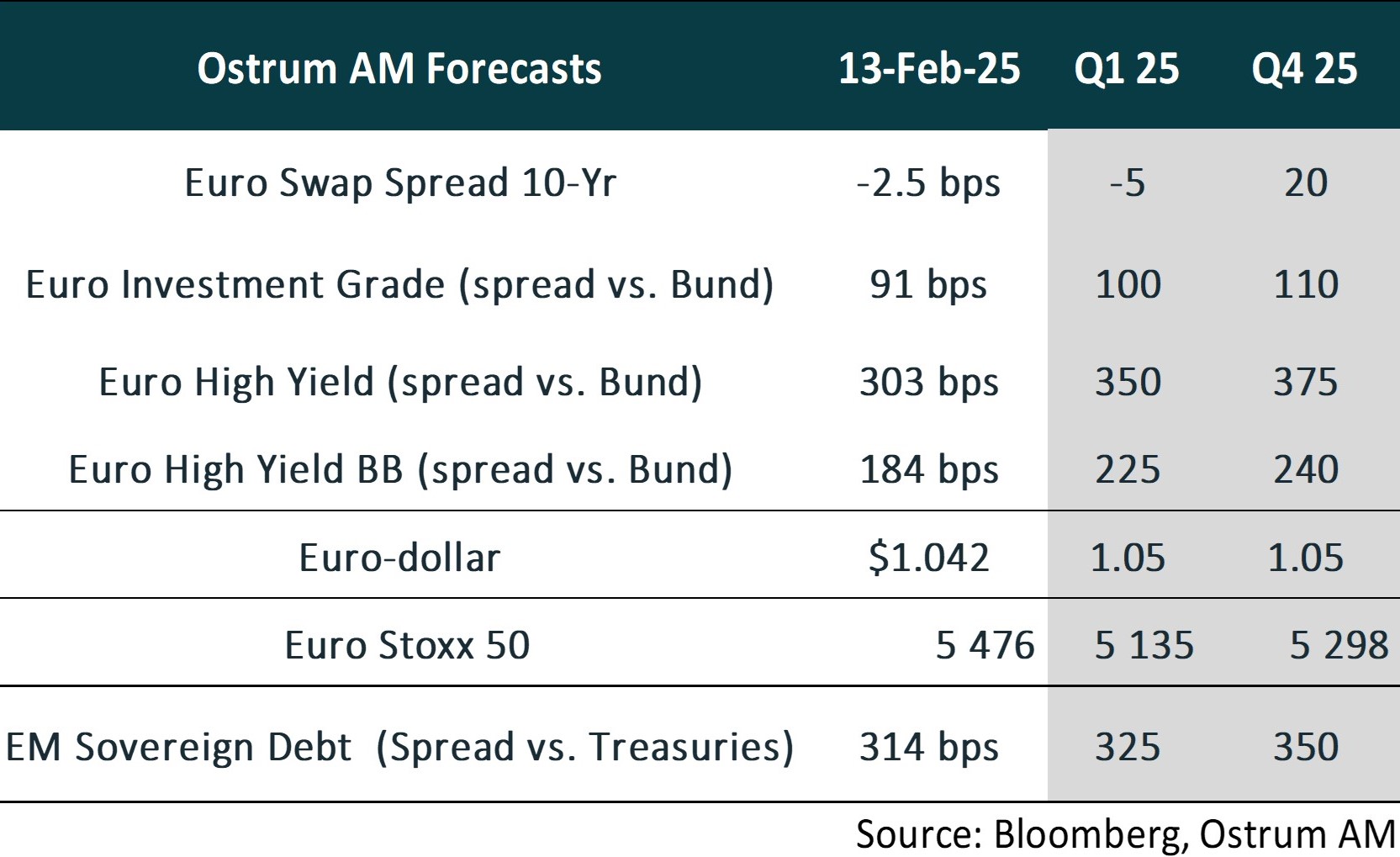

The Fed's new monetary status quo aims to curb inflation expectations, leading us to maintain our projection of 4.30% for the U.S. 10-year yield. In the euro area, the Bund is likely to hover around 2.30%, despite the ECB's quantitative tightening, which is contributing to the narrowing of European swap spreads. This spread tightening trend is evident across government bond and credit markets. Concerns regarding French debt have eased with the adoption of the budget for 2025, although a slight widening in high-yield spreads is expected, particularly given current valuation levels.

European equities are finally benefiting from a weaker euro, which remains stable below $1.05, allowing them to outperform US indices. Additionally, Chinese technology stocks enjoy a turnaround.

Economic Views

THREE THEMES FOR THE MARKETS

-

Monetary policy

The policy divergence between the Fed and other central banks is becoming more pronounced. The Fed has opted for a pause in its easing cycle, maintaining its federal funds rate at 4.25% to 4.5% in January as it takes time to assess Trump policies. In stark contrast, the ECB remains resolute to lower the deposit rate, towards neutral (2%). The ECB expresses confidence in achieving its target, even as service inflation hovers at 3.9%. Meanwhile, the PBOC continues to adopt an accommodative stance.

-

Inflation

The impact of tariffs remains uncertain, yet inflation expectations have deteriorated in the United States. US core inflation rose again to 3.3% in January. The total inflation stands at 3%. In the euro area, inflation rose to 2.5% in January, with service inflation still elevated at 3.9%. However, the slowdown in wage growth may prove to be more gradual than anticipated by the ECB. In China, inflation has rebounded to 0.5%, driven by seasonal effects related to the lunar new year festivities.

-

Growth

U.S. growth remains robust, driven by household consumption and a favorable labor market. Meanwhile, the euro area ended 2024 with a growth rate of 0.7%. Political uncertainty in France and Germany, coupled with the looming threat of tariffs, is expected to partially offset the positive impact of increased purchasing power and rate cuts. In China, growth reached the targeted 5% in 2024, primarily fueled by strong export performance. However, external pressures are anticipated to accelerate the need for structural reforms.

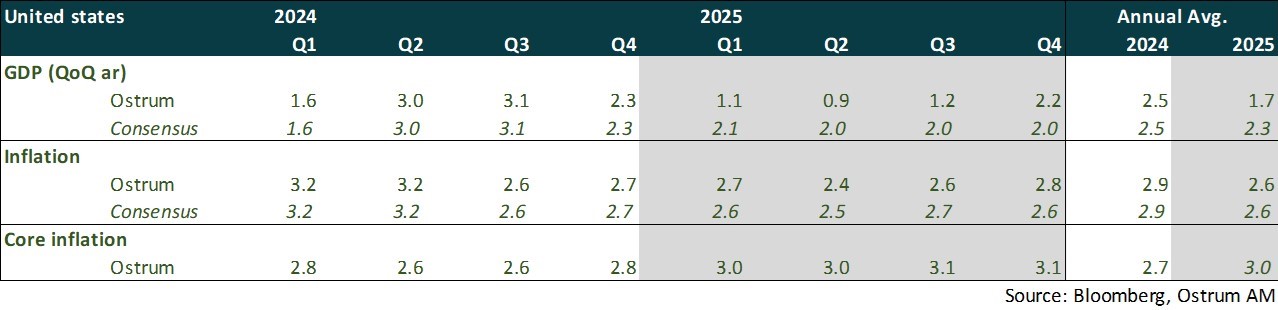

ECONOMY: UNITED STATES

Expect some weakness in 1H 2025 growth

- Demand: Durable goods consumption is expected to contract in the first half of the year. Productive investment is slowing down, despite self-financing and a renewed sense of confidence following Trump's election. The trade deficit has significantly worsened at the end of the previous year, leading to a downward revision of GDP forecasts. Imports are anticipated to correct themselves in the first half.

- Labor Market: A slowdown in migration flows are lowering the breakeven point for job creation (between 50,000 and 100,000 jobs) necessary to stabilize unemployment rates. Wage pressures and labor shortages, particularly in construction and services, are likely to intensify.

- Fiscal Policy: The budget is expected to be voted on in early April, with a focus on extending the Tax Cuts and Jobs Act (TCJA).

- Inflation: Inflation remains above target levels. While rental prices are projected to decelerate in 2025, the supply of multifamily housing is expected to pose challenges in 2026. Energy prices and imported goods are likely to keep inflation above the Federal Reserve's comfort zone.

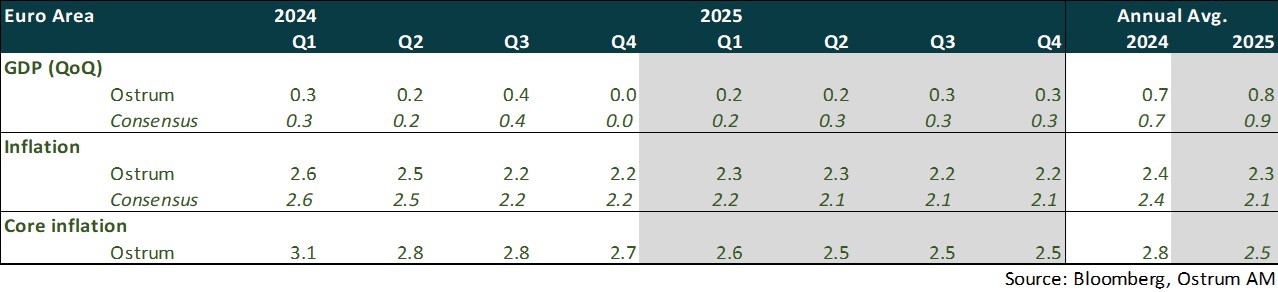

ECONOMY: EURO AREA

Growth is expected to be moderate in 2025. Political uncertainty in France and Germany, coupled with the threat of tariffs imposed by Donald Trump, is likely to partially offset the positive impact of increased purchasing power and the ECB rate cuts.

- Domestic Demand: Consumption is anticipated to strengthen slightly due to gains in purchasing power. However, political uncertainty is expected to weigh on corporate investment, while residential investment may see some improvement, supported by more favorable financing conditions. Peripheral countries are likely to ramp up the deployment of funds received under the NextGeneration EU initiative.

- Labor Market: Amid heightened uncertainty, business leaders are expected to adopt a more cautious approach to hiring. Nonetheless, the unemployment rate is projected to remain low.

- Fiscal Policy: Fiscal policy is unlikely to provide a boost to growth. Countries facing excessive deficit procedures, such as Italy and France, must take decisive action to reduce their public deficits. France's room for maneuver is limited, with the risk of a new dissolution of the National Assembly in July. Anticipated early legislative elections in Germany are scheduled for February 23.

- Inflation: Inflation is expected to moderate, yet remain above the ECB's target of 2%. The slowdown in wage growth is likely to occur at a slower pace than the central bank had anticipated.

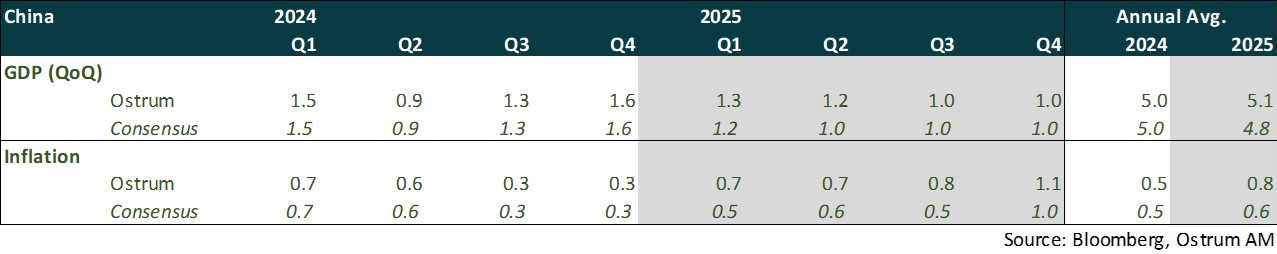

ECONOMY: CHINA

China has managed to sustain growth in line with its 5% target, buoyed largely by robust export performance. However, the outlook for 2025 raises questions amid recent economic indicators.

- Both the official and Caixin PMI surveys have signaled a slowdown in January, likely attributable to the early lunar new year festivities this year (January 29 to February 12) compared to the previous year. Nevertheless, household spending data during this festive period appears promising, particularly in the real estate sector. Still, broader economic activity necessitates additional support amid external pressures.

- In response to the United States' imposition of a 10% tariff on certain goods—accounting for 8.5% of its exports—China has implemented reciprocal tariffs, including a 15% levy on American coal and LNG, and a 10% tariff on other products effective February 10. Furthermore, Chinese authorities have initiated antitrust investigations against tech giants such as Google and Apple, alongside imposing stricter controls on exports of rare earth elements, including tungsten.

- China's strategy has evolved significantly since 2018. The current measures are more targeted, aimed at safeguarding domestic enterprises while penalizing American firms. Unlike in 2018, there are indications that the yuan will not be devalued to offset tariff impacts.

- Faced with mounting external pressures, it is anticipated that China will accelerate structural reforms. A recalibration of income distribution—potentially through social transfers and reforms to the Hukou system—could serve as a catalyst for revitalizing household consumption.

Monetary Policy

Divergence between the Fed and the ECB

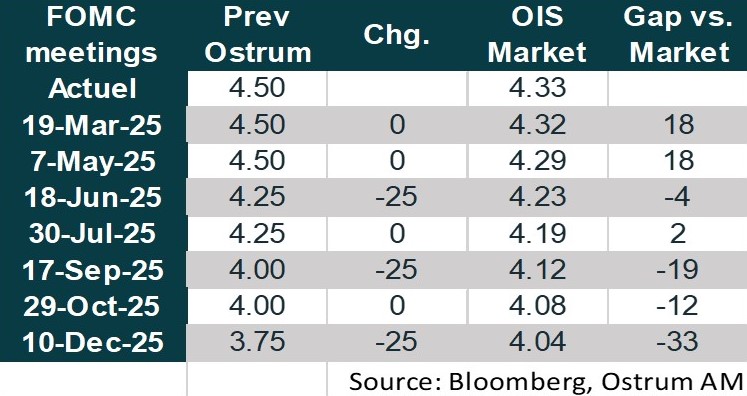

- THE FED PAUSES ITS RATE CUTS WHILE AWAITING MEASURES FROM D. TRUMP

After lowering its rates by a total of 100 basis points in the last three meetings, the Fed kept its rates unchanged in February. Strong growth, a solid labor market, and still "somewhat high" inflation were partly responsible for this decision. Additionally, there was an increase in uncertainty related to the measures announced and forthcoming from Donald Trump. During his testimony before Congress, Jerome Powell made it clear: the Fed should not rush to lower rates, and its policy should remain somewhat restrictive. The pause observed by the Fed will allow for an assessment of the impacts of Donald Trump's policies on both growth and inflation. In this context, we have revised our expectations for the Fed. It is expected to lower its rates more gradually and to a lesser extent. We anticipate three rate cuts of 25 basis points in June, September, and December. Furthermore, the Fed will continue to reduce its balance sheet. It must firmly resist any attempts to undermine its independence in order to preserve its credibility. - THE ECB KEEPS THE DOOR OPEN FOR FURTHER RATE CUTS

The ECB implemented its fifth rate cut of 25 basis points on January 30, bringing the deposit rate down to 2.75%. The central bank remains confident in the continuation of the disinflation process and the return of inflation toward the 2% target by 2025. Therefore, it has kept the door open for further rate cuts in order to move away from a restrictive monetary policy. The new estimate of the neutral rate provided by the ECB's services is in the range of [1.75% – 2.25%]. We believe that the ECB will lower its rates by 25 basis points at the next three meetings, bringing the deposit rate down to 2% by June. At the same time, it will continue to reduce the size of its balance sheet.

Market views

Asset classes

- U.S. Rates: The Federal Funds rate path is more uncertain giventhe growth backdrop but convergence towards a more neutral level remains likely.

- European Rates: The neutral rate is now estimated to be between 1.75% and 2.25%. The Bund is projected to hover around 2.30% by year-end, reflecting a persistent easing bias and some steepening pressure.

- Sovereign Spreads: OAT spreads have eased temporarily with the adoption of budget for 2025, but political risk lingers. The BTP-Bund yield gap appears best positioned given the improvement in the deficit.

- Eurozone Inflation: Long-term inflation expectations appear well anchored. A modest further increase in breakeven inflation rates nevertheless remains likely.

- Euro Credit: IG credit spreads trade on the rich side to their fair value.

- Euro high yield: the yield premium on high-yield bonds should normalize over time. Default rates remain low.

- Exchange Rates: U.S. Tariffs continue to support the dollar, although it appears to be overvalued. The euro will trade around $1.05 in 2025.

- Emerging Market Debt: Emerging market debt is currently expensive but benefits from the global risk-on financial environment.