Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Zouhoure Bousbih’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Xi Jinping Shifts Toward the Private Sector in Response to Internal and External Challenges

- Four years after the crackdown, the Chinese private sector has not managed to recover despite numerous declarations and gestures in its favor from the government.

- Instead of prioritizing a fiscal stimulus plan that would have had short-term effects on Chinese growth, Xi Jinping chose to encourage an innovative and autonomous private sector to ensure long-term economic success.

- This approach is fully in line with "The New Productive and Quality Forces" plan, which aims to increase China's productivity, which has remained stable since the 2008 financial crisis, while addressing the country's structural issues.

- The high-tech sector has now become the pilar of China's national competitiveness to face external pressures.

- The regulatory framework should be swiftly relaxed to enable private enterprises to play a crucial role in the national strategy.

Market review: Trump puts pressure on European sovereign bond markets

- Concerns about an increase in bond issuances in Europe to finance military investments;

- Tensions on long-term European and Japanese rates contrasting with the easing of U.S. rates;

- The Yen below 150 against the dollar in anticipation of rate hikes by the BoJ;

- Stock markets slightly down following mixed earnings results.

Axel Botte’s and Zouhoure Bousbih’s podcast

- Review of the week – Consumer trust, warning from Walmart;

- Theme – Xi Jinping Shifts Toward the Private Sector in Response to Internal and External Challenges.

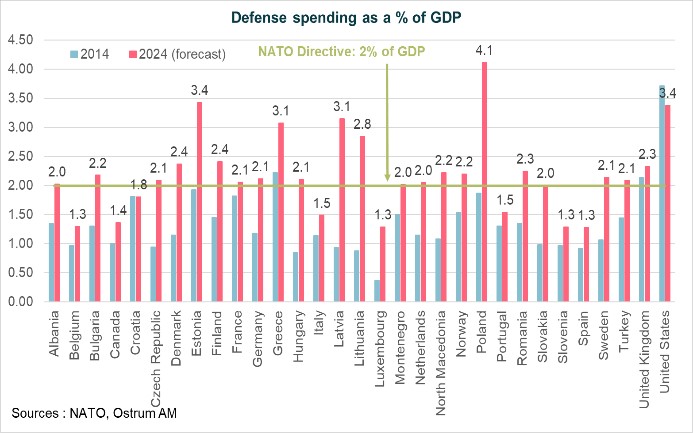

Chart of the week

Recent comments from the new U.S. administration regarding the war in Ukraine suggest a reduced commitment from the United States to NATO, prompting European nations to significantly increase their defense spending.

Currently, only France and Germany are expected to meet NATO's target of 2% of GDP. Several financing options were discussed during the Paris Defense Summit, including the exclusion of defense expenditures from EU fiscal rules, the utilization of existing EU funds and facilities, and the creation of a new EU defense fund financed through joint debt issuance.

The impact has been significant: long-term European sovereign bond yields have risen, reflecting an increase in term premiums.

Figure of the week

85

85% of Switzerland's gold exports are destined for the United States! The country has seen an increase in transfers to the U.S. in recent months due to concerns that tariffs may impact the precious metal.