Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Towards a decrease in the Fed funds rate in September

- The Fed sees the risks regarding the achievement of its price stability and employment objectives as more balanced;

- The job market has normalized, and inflation has significantly moderated, but it still remains above the 2% target followed by the central bank;

- During his semi-annual congressional testimony, Jerome Powell indicated that the Fed needed more "good data" to be more confident in achieving its inflation target;

- The lower-than-expected inflation in June is undeniably one of them;

- This argues for a decrease in the Fed's rates during the September meeting.

Market review: Between the euphoria related to US inflation and political uncertainty

- Sharp drop in bond yields after US inflation;

- The 10-year OAT spread stabilizes around 65 basis points due to political uncertainty;

- The sovereign spreads of peripheral countries are narrowing;

- Significant rotation in US stocks following the US inflation.

Aline Goupil-Raguénès' podcast

- Topic of the week: Market News, Uncertainty in France and ECB Bank Lending Survey;

- Theme: Towards a decrease in the Fed funds rate in September.

Chart of the week

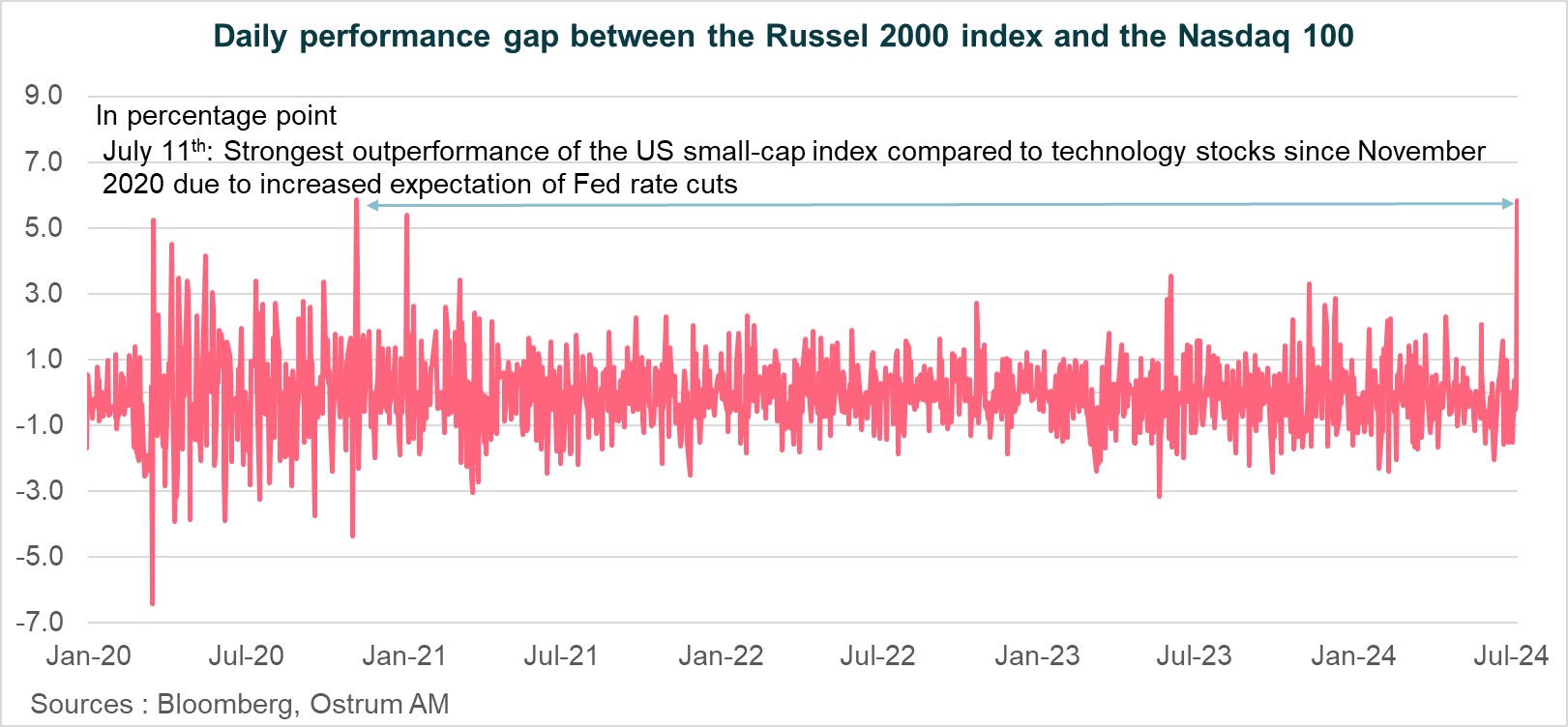

On July 11th, the US small-cap index (Russell 2000) recorded its strongest outperformance against the Nasdaq index since November 2020 (+5.8 percentage points).

This was the result of increased expectations of a Fed rate cut following the release of lower-than-expected inflation rates. Investors took their profits on technology stocks, which had seen significant gains, and invested in overlooked stocks that were more likely to benefit from Fed rate cuts (such as the construction sector).

As a result, the Russell increased by 3.6% and the Nasdaq decreased by 2.2% for the day.

Figure of the week

In France, the Olympic Games are expected to have a temporary impact of around 0.3 percentage points on GDP in the third quarter, according to estimates from INSEE. The institute is basing its analysis on the London Olympics Games, which were estimated to have had an impact of between 0.2 and 0.4 percentage points on GDP in the third quarter of 2012.

Source: INSEE