Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: US stocks: the dispersion trade, are tails wagging the dog?

- The US S&P 500 is up 15% with moderate levels of volatility so far this year;

- The stellar index performance is traceable to large cap stocks but a lot is happening under the surface, with unprecedented low correlation within stocks;

- The dispersion trade has been increasingly popular among market participants;

- Remember the Volmaggedon Krach in January 2018, the unwinding of crowded trades can always be painful;

- What breaks the dispersion trade is anyone’s guess at this juncture.

Market review: The markets facing political uncertainty and global computer breakdown

- The ECB maintains the status quo, leaving the door open for a rate cut in September;

- Divergence between the US and European bond markets;

- Decline in stock markets affected by technology stocks;

- The Vix index at its highest since April following political uncertainty and global computer breakdown.

Axel Botte's podcast

- Topic of the week: Market news, ECB meeting and growth in China;

- Theme: Equity markets, the dispersion trade.

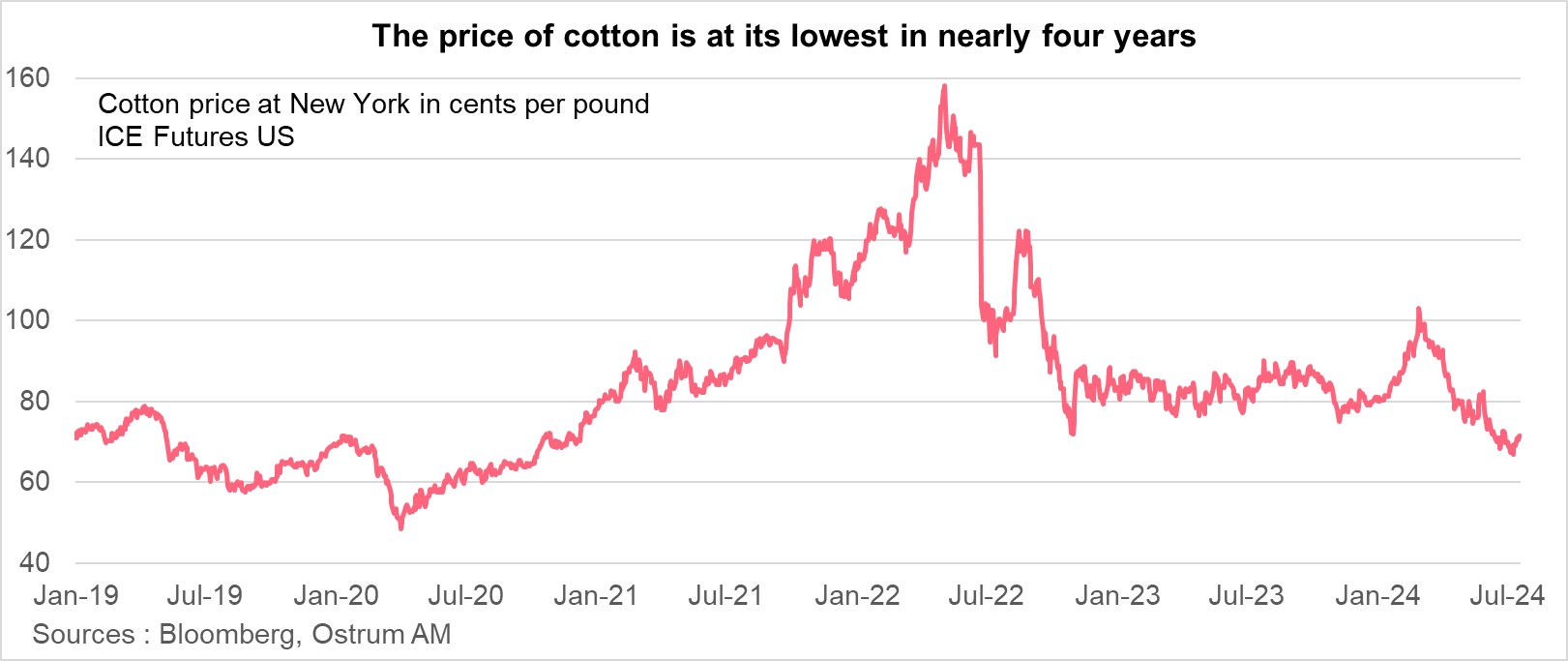

Chart of the week

The price of cotton, listed in New York, reached a low not seen since October 2020. It settled at 71.4 cents per pound on the ICE Futures market on July 19, and even dropped to 67.3 cents on July 3.

This is a result of the sharp increase in production in Brazil, which has become the world's leading exporter, surpassing the United States. The decline in the price of corn over the past two years has prompted Brazilian producers to cultivate cotton.

At the same time, global demand for cotton has decreased since the Covid-19 crisis due to inflation and higher interest rates. Consumers are opting for textiles made from less expensive fibers, such as polyester.

Figure of the week

Business leaders in the eurozone anticipate a gradual slowdown in annual wage growth to 3.5% in 2025, after an expected 4.3% in 2024 and 5.4% in 2023, according to the ECB survey. This would bring them back to a pace more in line with the ECB's 2% inflation target by 2025.

Source: ECB