Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Three risks to our 2024 scenario

- US protectionism, and to some extent European protectionism, has weighed on global trade since Donald Trump's election in 2016. Today, China's export capacity poses an existential threat to emerging industries related to the energy transition, such as electric vehicles, in Europe and the United States. Escalating protectionist measures would likely have significant implications for international trade and goods inflation;

- Recent wage negotiation data in the Eurozone raises concerns about the formation of a wage-price spiral that is incompatible with a sustainable return of inflation to the 2% target. Sustained additional inflation would challenge the ECB's ability to act, particularly with limited fiscal flexibility;

- The healthcare and social assistance sector has been a major job creator in the United States over the past two years. A reform of the ACA or a reduction in Medicaid funding could have significant consequences for healthcare spending and the labor market in general.

Market review: Is the ECB taking an unnecessary risk?

- ECB cuts rates by 25 bp whilst raising its inflation forecast for 2025;

- FOMC meets this week after another solid job report;

- T-note yields moving wildly between 4.30 % and 4.60 % over the past month;

- Equities on a positive note whilst sovereign and credit spreads remain stable.

Axel Botte's podcast

- Topic of the week: Market news and central banks;

- Theme: Questions on the French spread.

Chart of the week

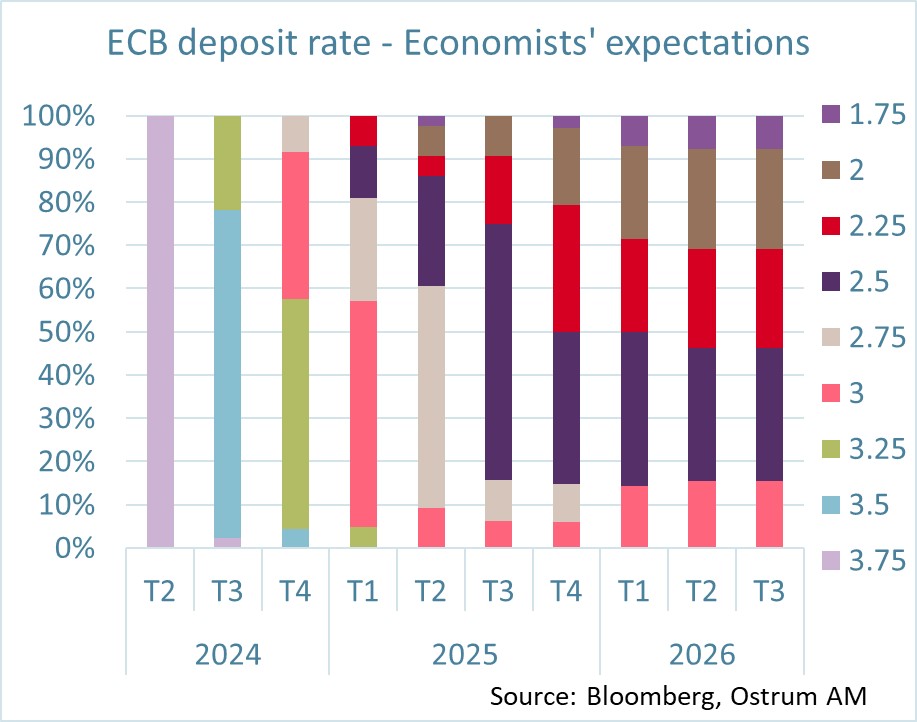

There is considerable uncertainty about the level of interest rates over the next two years. The survey of Bloomberg economists illustrates the distribution of ECB rate expectations collected before the ECB meeting on June 6th.

A large majority of economists are forecasting a cut in September, followed by one or two additional cuts in the fourth quarter. The deposit rate appears to be below 3% in all cases from the second quarter of 2025.

Figure of the week

The market capitalization of Nvidia surpassed that of Apple by over 3 trillion dollars this week. At current prices, Nvidia, Apple, and Microsoft are worth more in the stock market than the entire Chinese market.

Source: Bloomberg