Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO Letter

The political risk will be crucial in the second semester

In the span of a few weeks, the United Kingdom and France have announced early elections. Concerns arise over potential tensions on French and European rates ahead of a year animated by the American presidential election. In the emerging world, the Mexican and South African elections have led to a sharp decline in the peso and the rand.

Thus, political risk resurfaces as the Eurozone economy was experiencing a nascent recovery. Economic activity is now moderating in the United States but remains in line with its potential. Chinese growth, driven by exports, is now subject to the reflex of American and European protectionism.

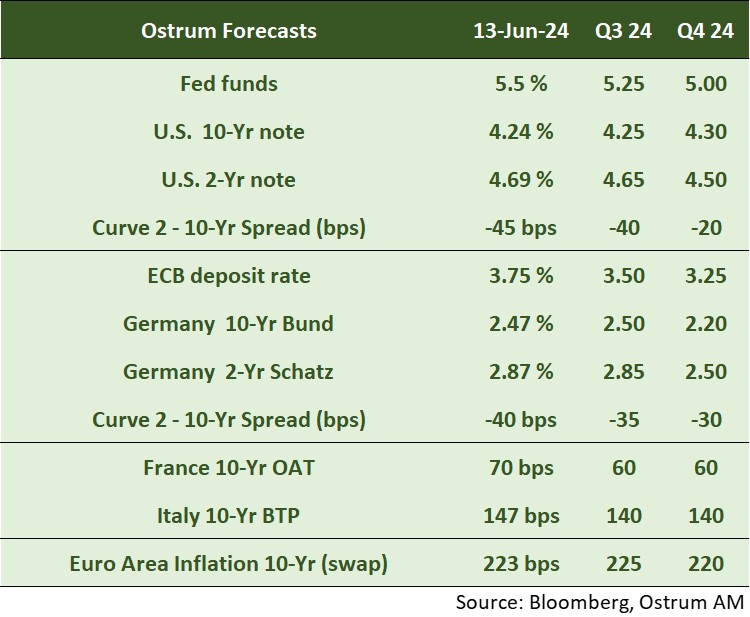

The ECB has lowered its deposit rate to 3.75% despite upwardly revised inflation forecasts for 2025. The Bank of Canada also seems to be embarking on an easing cycle, but other central banks, such as the Reserve Bank of Australia and the Reserve Bank of New Zealand, are more cautious. The Fed is scaling back the expected rate cuts this year, but its quantitative policy has already loosened.

This monetary environment provides support for risky assets, but also poses a risk for inflation. Long-term interest rates are expected to hover around 4.50% in the United States and 2.70% on the Bund. Sovereign spreads, currently narrow, are once again subject to political risk. Credit benefits from the narrowing of swap spreads, and high yield presents stretched valuations but remains in line with the low default rate. Stock market indices continue to be driven by a few large American companies, masking lackluster performance in smaller capitalizations. However, inflation allows for a delay in the normalization of margins.

Economic Views

Three themes for the markets

-

Monetary policy

The ECB has lowered interest rates without committing further, given the inflation outlook for 2025. Meanwhile, the Fed anticipates two rate cuts this year, acknowledging the slow pace of disinflation. Monetary policy has eased in Canada, but other central banks remain cautious about inflation. The BoJ is gradually reducing its QE to support the yen and is expected to raise rates again in the second half of the year.

-

Inflation

After an initial phase of rapid disinflation, the second phase is proving to be slower, partly due to wage pressures. In the United States, inflation is slow to return to target. It decreases slightly to 3.4% in April, with the core index at 3.6%. In the Eurozone, inflation rebounded to 2.6% in May, with the core index at 2.9%. Service sector inflation remains close to 4%. In China, inflation remains almost non-existent, at 0.3% in May, due to weak domestic demand.

-

Growth

In the United States, the slower growth in the first quarter signals a return to potential in line with the normalization observed in the labor market. The unemployment rate stands at 4% in May. After a contraction in the second half of 2023, the Eurozone is experiencing an upturn, including in Germany. The political risk is a concern. In China, the first quarter of 2024 has seen positive growth surprises, driven by exports. However, the escalation of protectionism poses a potential obstacle to the recovery.

Key macroeconomic signposts : United States

- The U.S. economic growth slowed to 1.6% in the first quarter. However, private consumption and investment (excluding stocks) remained robust. Petroleum product exports declined in March, resulting in a negative contribution to the trade balance (-0.9 percentage points between January and March). The housing sector surged by 13.9%, but there was an unexpected drop in military spending (-0.6%).

- The federal deficit is expected to reach around $1.6 trillion in 2024. Tax revenues saw a rebound in April, particularly from capital gains taxation. A $95 billion package for military aid (to Ukraine, Israel, and Taiwan) was approved.

- Financial crisis risks remain contained. The NYCB incident is seen as a reflection of Signature Bank and not a precursor to a banking crisis. Household balance sheets remain healthy, but there is a concern about the rise in credit card defaults, with annual interest expenses exceeding one trillion dollars.

- The unemployment rate remains below its equilibrium level (4-4.5%). The Fed does not anticipate a significant increase. Immigration has contributed to growth, and a halt to immigration would have stagflationary implications.

- Inflation is on an uncertain trajectory, stabilizing around 3% (CPI). The housing and other services sectors are not compatible with a 2% inflation target.

Key macroeconomic signposts : Euro area

- After 5 quarters of flat or slightly negative growth, the GDP of the Eurozone rebounded in Q1 2024 more strongly than expected.

- This has affected all major economies, including Germany, which is experiencing growth again after a sharp contraction in Q4 and sluggish growth in the first half of 2023. This is linked to exports and residential investment, while consumption has decreased.

- The Eurozone's recovery in the first quarter is mainly linked to a rebound in external trade.

- The recovery in the Eurozone will intensify, especially in the second half of the year. It will be driven by a rebound in household consumption.

- Households will benefit from increased purchasing power as wages are rising at a faster pace than inflation. Coupled with a strong labor market, this will support consumption.

- Domestic demand should also benefit from a monetary policy that will become less restrictive starting in June, and exports from a strengthening of global trade.

- On the other hand, fiscal policy will be a drag on growth. After being suspended since 2020, budgetary rules were reinstated in January and a reform was adopted. Following budget overruns in 2023, France and Italy are required to take consolidation measures. This comes at a time when France is facing political risk following the dissolution of the National Assembly.

- After an initial phase of rapid disinflation, the second phase is proving to be slower. This reflects wage pressures, the end of the very favorable base effect on energy prices, and the cessation of measures to contain price increases. In a context of low productivity, business margins have a crucial role to play in continuing disinflation.

Key macroeconomic signposts : China

- Sentiment towards Chinese economic prospects has significantly improved, as evidenced by the upward revision of the IMF's growth forecast to 5% from 4.6% in April, driven by the scale of recent measures to curb the real estate crisis. Forecasts from both consensus and the IMF are now converging towards our forecast of 5.4% for 2024.

- The scale of the new measures for the real estate sector has been positively surprising. The government has become the "buyer of last resort" for unsold housing stocks. Other measures have also been announced to stimulate demand: a reduction in the average mortgage rate to 3.69% and a lowering of the down payment rate for home purchases to historic lows.

- We believe that these new measures should help stabilize the Chinese real estate sector at its low points, and the Chinese authorities are ready to step up efforts if necessary to curb the real estate crisis negatively impacting consumption.

- Having heavily supported the manufacturing sector, especially the "3 new industries," the Chinese authorities are now determined to strengthen domestic demand in the face of external uncertainties. To achieve this, the authorities must boost confidence in the private sector (which accounts for 60% of GDP and 80% of employment), hampered by weak domestic demand and the government's crackdown policy. If the trend in the private sector does not reverse, China will struggle to generate innovation and the jobs needed to support a consumption-based economy and offset the loss of the real estate sector as a growth engine.

- The July 3rd plenum is expected to resemble the historic 1978 plenum, which led to the opening of reforms for the Chinese economy.

Monetary Policy

The ECB cuts its rates ahead of the Fed

- The Fed is on hold

As expected, the Fed left its rates unchanged at the end of its meeting on June 12 and 13. The statement marginally changed regarding inflation, as "modest progress" was noted, while in May it stated "lack of further progress" in reaching the 2% inflation target. The forecasts of FOMC members show that 8 of them consider it desirable to lower rates twice in 2024, 7 wish for a rate cut, and 4 advocate for a status quo (the median indicates a rate cut). We anticipate 2 rate cuts by the end of the year. The accommodative bias remains in place through the reduction in the pace of balance sheet contraction ($60 billion per month compared to $95 billion previously). - The ECB is making its monetary policy slightly less restrictive

As it had nearly pre-announced during the April meeting, the ECB lowered its interest rates on June 6, after opting for a status quo for 9 consecutive months. It reduced them by 25 basis points to bring the deposit rate to 3.75%. The decline in the inflation rate by more than 2.5 percentage points since September and the improvement in inflation prospects were the main reasons for this decision. Monetary policy still remains very restrictive, and the ECB emphasized that it did not commit in advance to a trajectory for interest rates. Its decisions will depend on data, particularly on the evolution of wages, which continue to increase at a sustained pace. We anticipate two more rate cuts by the end of the year. Starting in July, the balance sheet contraction will accelerate, with the ECB reinvesting only half of the PEPP (at an average monthly rate of 7.5 billion euros) before ending it in late 2024.

Market views

Asset classes

- US rates: the Fed is expected to cut its rate twice in the second half of the year. The monetary relief will keep the T-note below 4.30%.

- European rates: the Bund is trading around 2.50% despite a first rate cut by the ECB. However, the German 10-year yield is expected to fall back to around 2.20% by the end of the year.

- Sovereign spreads: political risk in France is reviving volatility on the OAT in the first place and the asset class in general.

- Eurozone inflation: breakevens are broadly stable despite upside surprises on inflation.

- Euro credit: spreads are expected to remain stable around 110 bps against the Bund. High yield valuations are tighter and spreads will widen.

- Currency exchange: the euro, subject to the return of political risk, is expected to weaken towards $1.06.

- Equities: the normalization of margins and a decline in multiples imply a return of the Euro Stoxx 50 to around 4,900.

- Emerging market debt: The rise in spreads is due to Venezuela's return to the index and is not significant. Stability should prevail by the 3rd quarter.