Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The cio letter

The Fed starts its easing cycle

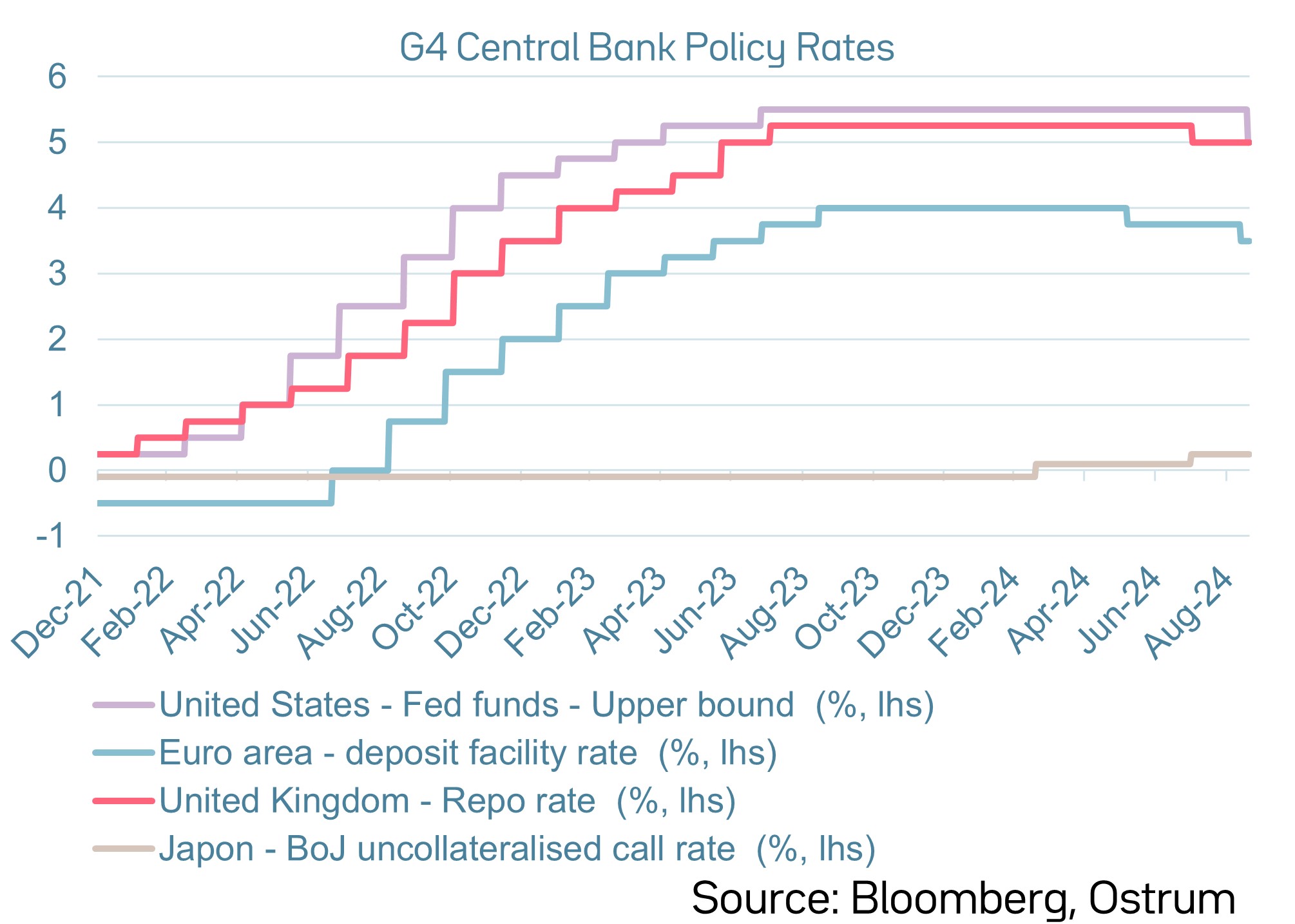

After a summer marked by politics in France and the United States, the news is once again dominated by central banks. After a second cut by the ECB, the Fed has joined the party. The BoJ is the only central bank to consider rate rises in this context. The Chinese central bank continues to ease whilst aiming at a steeper yield curve.

Activity remains solid in the United States, despite a slowdown in job creations in the third quarter. In the euro area, Germany is still in a recession while the French economy has benefited from an Olympic games boost. Chinese growth remains primarily driven by exports, with domestic demand requiring monetary and budgetary support.

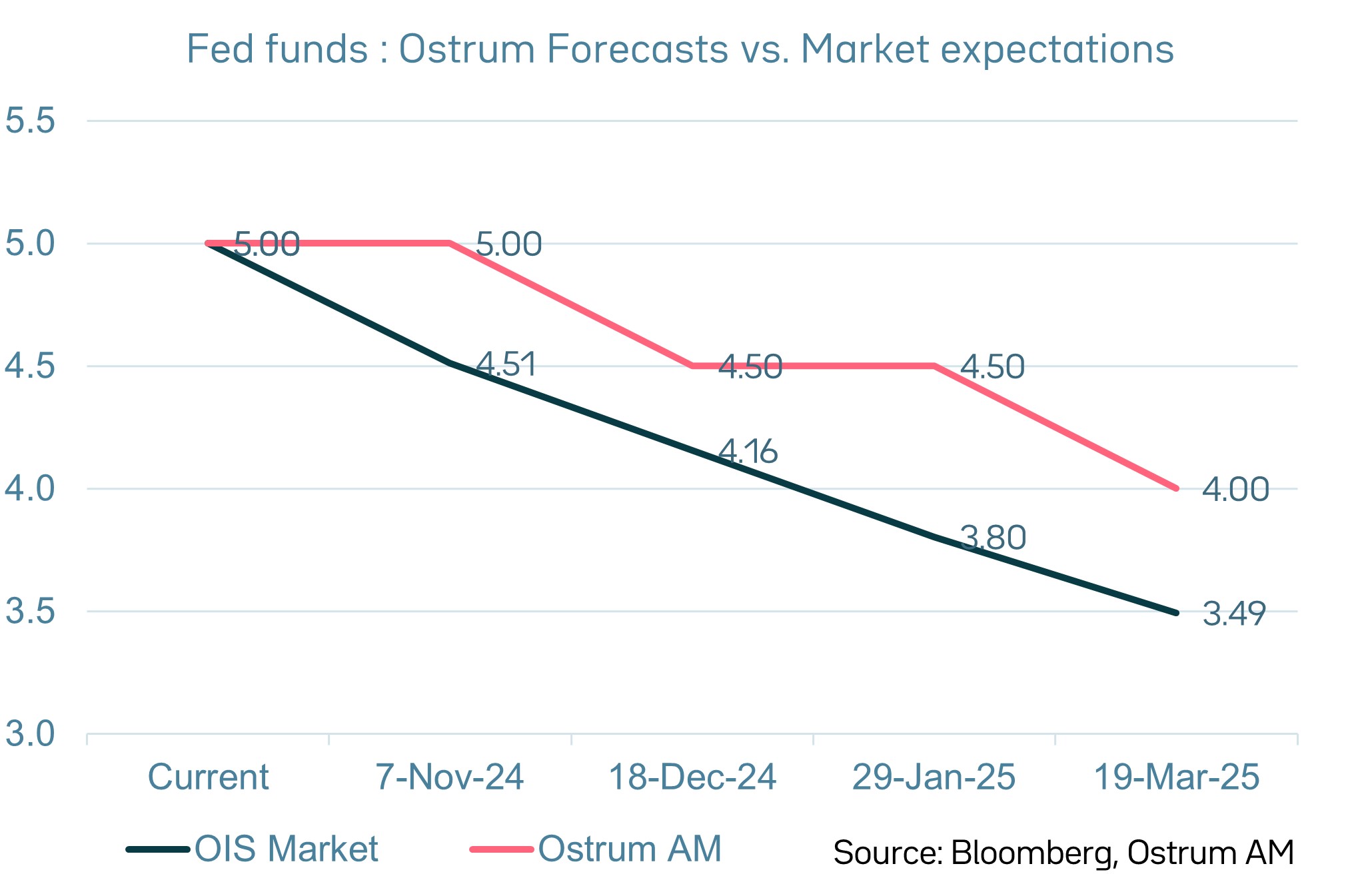

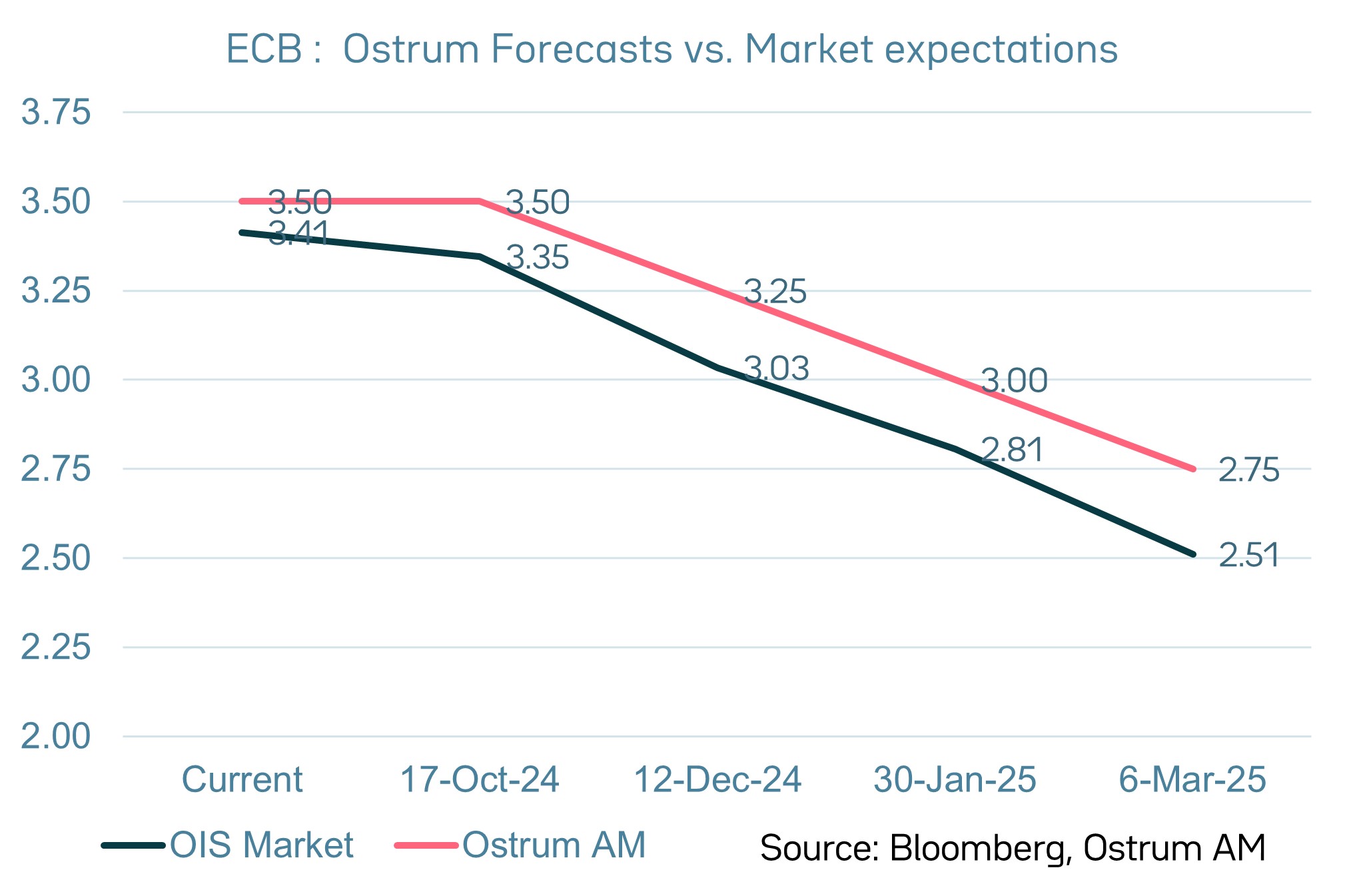

By cutting rates by 50 bps, the Fed is mainly responding to rising unemployment (4.2% in August). Market expectations for Fed easing, however, seem excessive at this stage. In turn, the ECB will keep cutting rates steadily. The BoE may also cut rates each quarter.

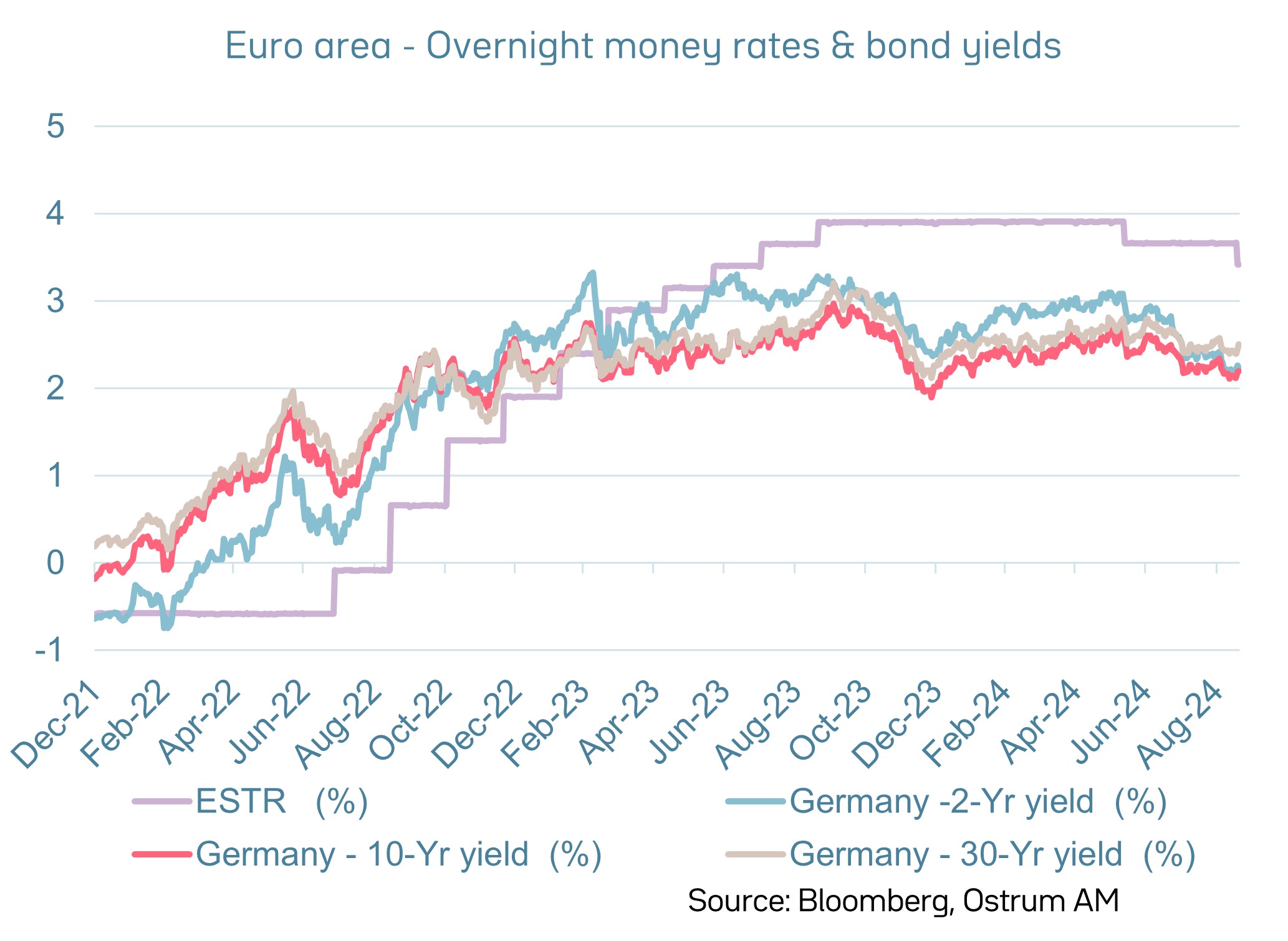

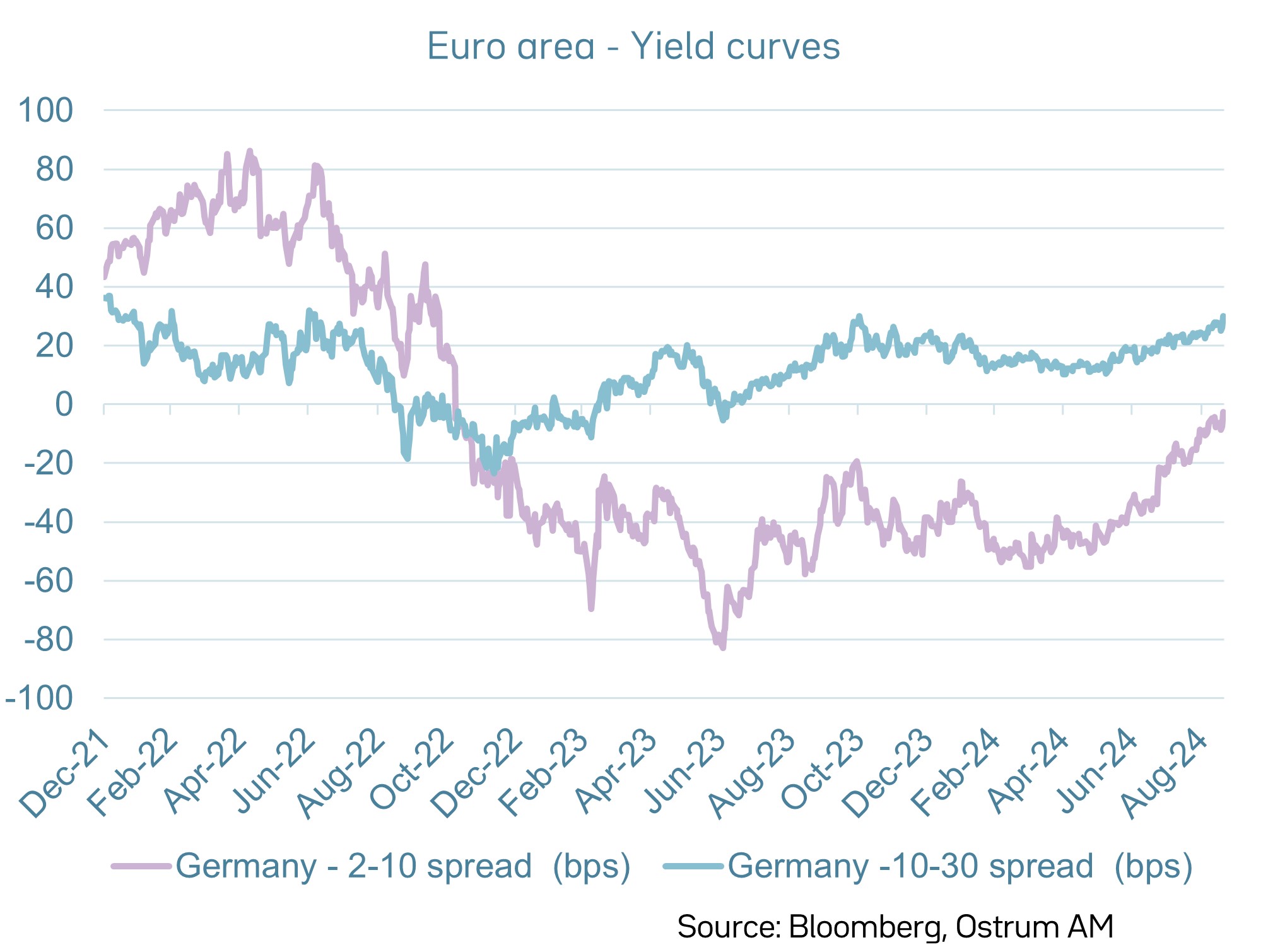

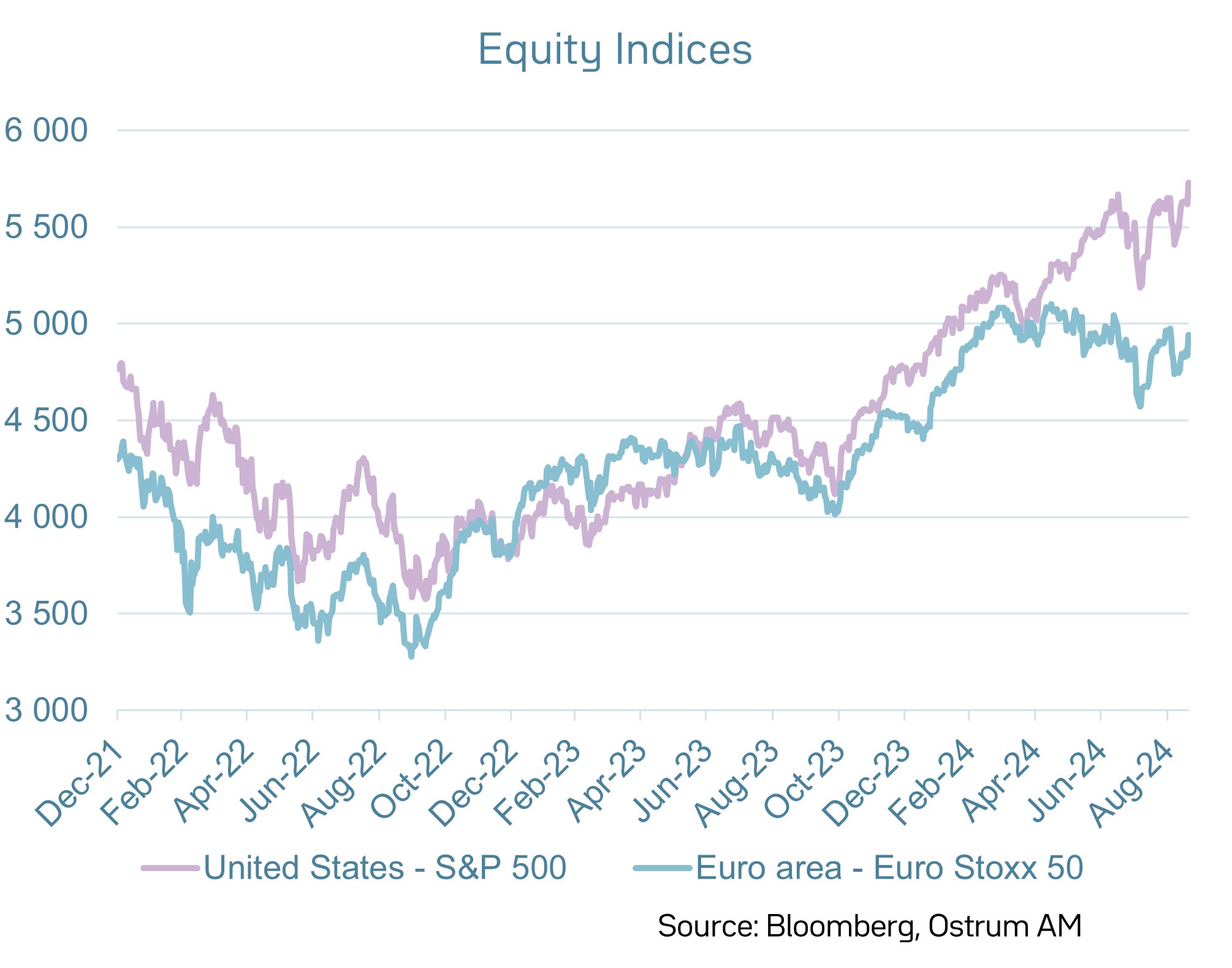

Monetary easing fuels the curve steepening, especially in the United States. Valuations may seem stretched but the Fed's stance keeps a lid on bond yields. The Bund yield is expected to remain around 2.20%. The spread on French bonds is not expected to tighten rapidly given the fiscal challenges. Credit spread valuations have cheapened. High yield remains somewhat expensive but low default rates support the asset class. Equity markets are in trading range since spring, thanks to high profit margins and valuation multiples.

Economic Views

Three themes for the markets

-

Monetary policy

The ECB cut interest rates by 25 bp in September for the second time this year. Another rate reduction is expected in December. The Fed initiates its cycle of interest rate cuts with a 50 basis point reduction. Another reduction of the same magnitude is expected by the end of the year. The BoE will cut rates again in November on slower wage gains and service inflation. On the other hand, the BoJ will raise rates further and reduce asset purchases. The PBoC continues its regular monetary easing policy.

-

Inflation

Inflation has slowed further due in large part to lower energy prices. In the United States, inflation keeps falling (2.5% in August), although core inflation remains above 3%. In the euro area, inflation has stabilized around 2.5%. However, service sector inflation is back above 4%. UK inflation is close to target as service inflation is finally moderating. China’s inflation is still below 1%.

-

Growth

In the United States, GDP growth (3%) surprised on the upside in the second quarter. Unemployment is creeping higher to 4.2% in August. The recovery in the euro area economy is quite uneven. GDP expanded by 0.2% in 2Q, held by back poor private-sector domestic demand. Germany is still in a recession. In China, GDP growth remains unbalanced and subject to internal financial and real estate risks.

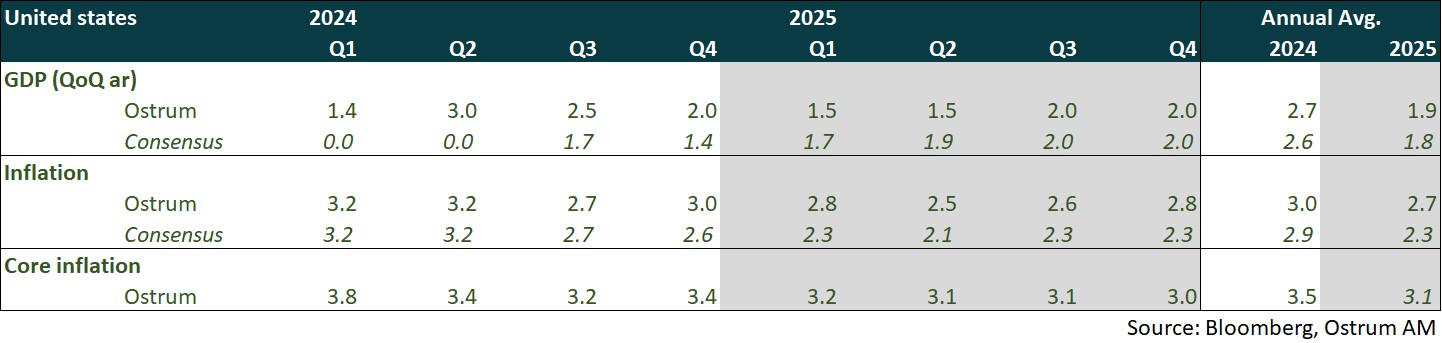

Key macroeconomic signposts: United States

- The US economy grew in line with potential output growth in the first half of the year. Household consumption and private investment (excluding stock building) remain robust, although the trade balance is deteriorating. Residential investment appears to be improving in the third quarter, but housing construction remains inadequate. Public spending continues to support economic activity.

- The unemployment rate stood at 4.2% in August. Job openings continue to decline. Job creation is likely to average about 100k per month over the next few months.

- The federal deficit is expected to reach around $1.6 trillion in 2024. While tax revenues are recovering, three-quarters of federal spending is non-discretionary. A $95 billion package of foreign military aid has been approved. The interest burden exceeds one trillion dollars annually.

- Despite some signals of deterioration in credit quality on credit cards and commercial real estate, the risk of a financial crisis remains low. Banks keep lending, as monetary easing appears to be on the horizon.

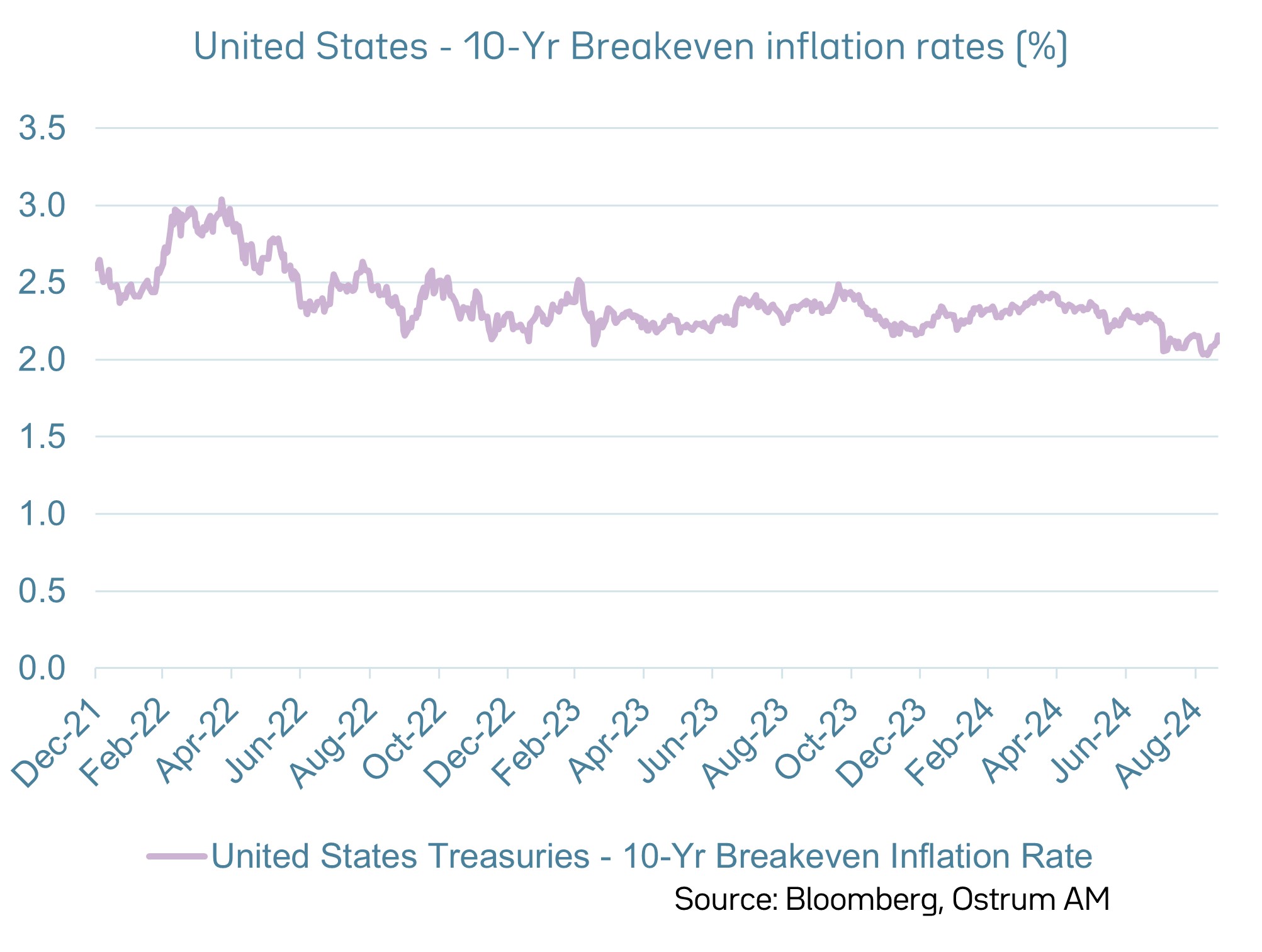

- Inflation is gradually receding, though housing inflation remaining a primary concern. However, service prices (excluding housing) have moderated, and the recent decline in crude oil prices is accentuating disinflation.

In summary, the US economy appears to be generally stable, but some signs of fragility are beginning to emerge.

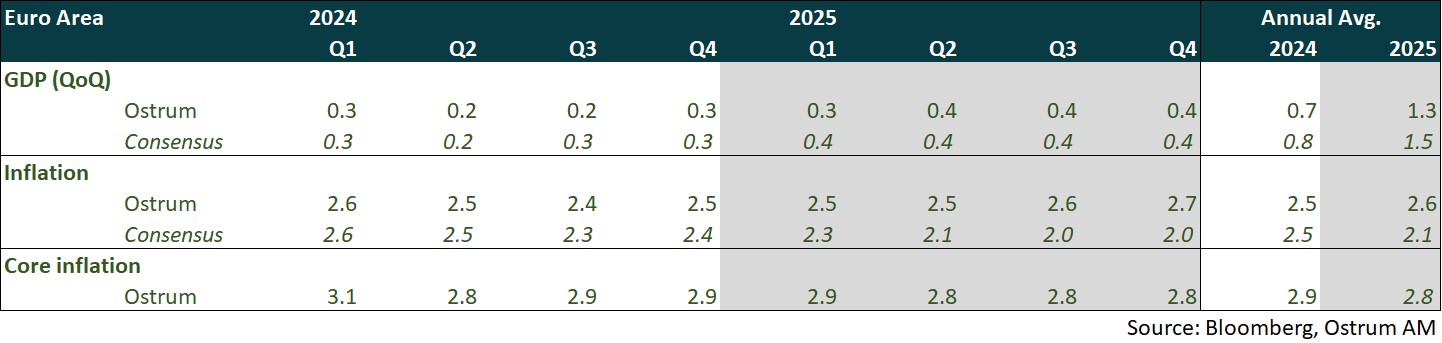

Key macroeconomic signposts: Euro area

- A slow recovery began in the first half of the year in the eurozone after sluggish growth in 2023. This recovery is traceable to external trade. However, domestic demand is contributing negatively to growth. Consumption is lackluster, and investment has declined for the second consecutive quarter in Q2.

- The growth situation is uneven. German is in a recession, while France and Italy record moderate growth with robust activity in Spain. The manufacturing sector continues to contract sharply, while activity is progressing in the services sector.

- The euro area's recovery is expected to strengthen gradually thanks to a rebound in household consumption. Consumers are benefiting from increased purchasing power as wages outpace inflation amid excess demand for labor. Monetary policy easing will also support domestic demand.

- However, fiscal policy will be restrictive. Corrective measures need to be taken, particularly in France and Italy, following budgetary overruns.

- After an initial phase of rapid disinflation, the second phase is proving to be slower despite falling energy prices. Service inflation is expected to remain elevated due to persistent wage pressures.

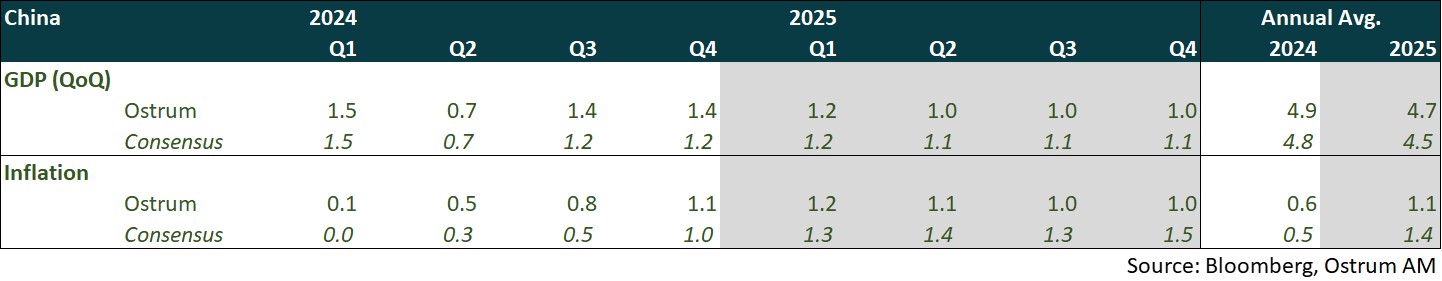

Key macroeconomic signposts: China

- A two-speed recovery. Chinese activity continues to be driven by exports, while consumption remains subdued due to the real estate crisis.

- The real estate sector shows timid signs of stabilization. Authorities are expected to increase their support.

- The PBoC governor announced a new monetary policy framework. The goal is to converge towards international standards such as that of the Fed.

- The framework includes: 1/ Simplification of the PBoC's main interest rates. The 7-day reverse repo rate, a short-term rate, is expected to be the central bank's main interest rate. – 2/ Gradual negotiation of government bonds to control the sovereign yield curve and better coordinate monetary and fiscal policy. – 3/ Regulatory and statistical changes, such as the inclusion of household deposits in the M1 monetary aggregate, currently included in M2, to converge towards international standards.

- The PBoC remains determined to control the depreciation of its currency against the dollar by using the yuan's central parity rate.

- China has indicated it will increase its customs duties on European agricultural products, particularly from Spain and Italy, in retaliation for the European Union's 38% tariff increase on its electric vehicles.

- Shortly after the Third Plenum, where no concrete measures to support demand were announced, the PBoC lowered its rates to support the economy.

Monetary Policy

The monetary easing cycle has been launched

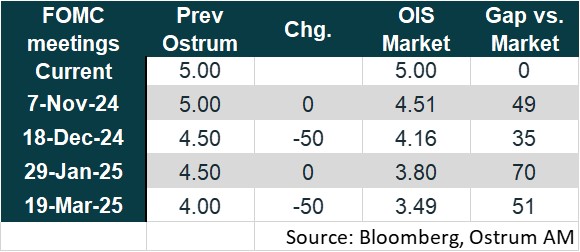

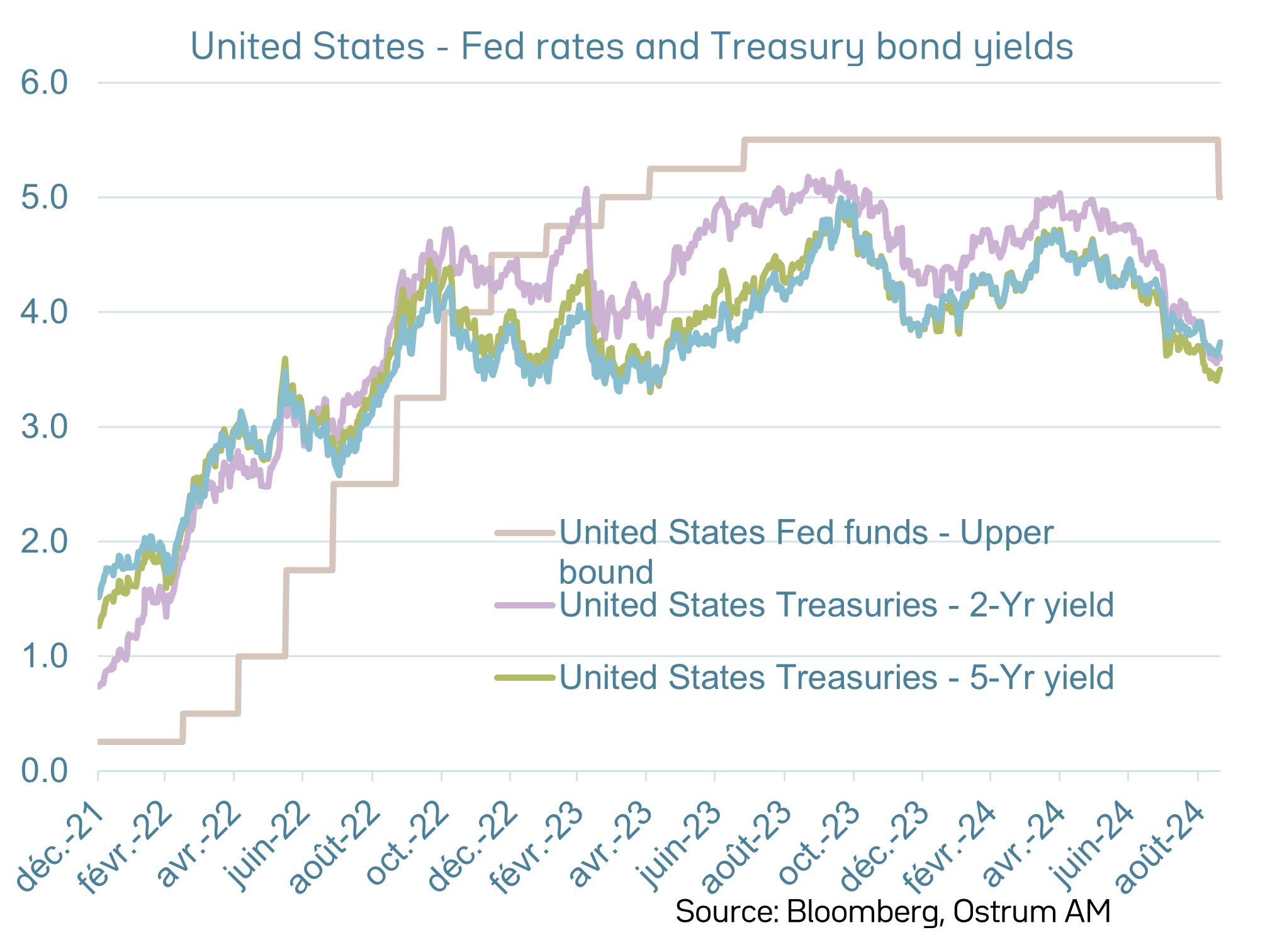

- The Fed is kicking off its interest rate cut cycle strongly

On September 18th, the Fed implemented its first interest rate cut since March 2020, reducing rates by 50 basis points to bring the federal funds rate range to [4.75%-5.00%]. This "recalibration" to make monetary policy less restrictive is motivated by significant progress in inflation amidst a slowing job market. With reassurance on inflation, the Fed is focusing on its second mandate: achieving maximum employment and avoiding a significant slowdown in employment. The members of the monetary policy committee anticipate an average of 50 basis points of rate cuts by the end of the year and 100 basis points in 2025. Additionally, the central bank has been making its monetary policy more accommodative since June through the reduction in the rate of contraction of the size of its balance sheet. We anticipate a 50 bp rate cut by the end of the year. - Gradual decrease in ECB interest rates

The ECB carried out its second interest rate cut since June on September 12th. The deposit rate was reduced to 3.50% (-25 basis points) and the corridor between the deposit rate and the refinancing rate was reduced to 15 basis points, as announced in March. The inflation outlook of the ECB's services has not changed, reassuring the central bank that inflation will return to around 2% by the end of 2025. However, the central bank remains cautious due to persistently high inflation in services resulting from wage pressures. As a result, the ECB did not provide advanced indications regarding the evolution of its monetary policy, reiterating that decisions would be made based on data, meeting by meeting. We anticipate a third 25 basis point rate cut by the ECB in December. Meanwhile, the central bank continues to reduce the size of its balance sheet through repayments of TLTRO, the end of reinvestments from the APP, and partial reinvestment of PEPP redemptions (at an average monthly pace of 7.5 billion euros) to conclude by the end of 2024.

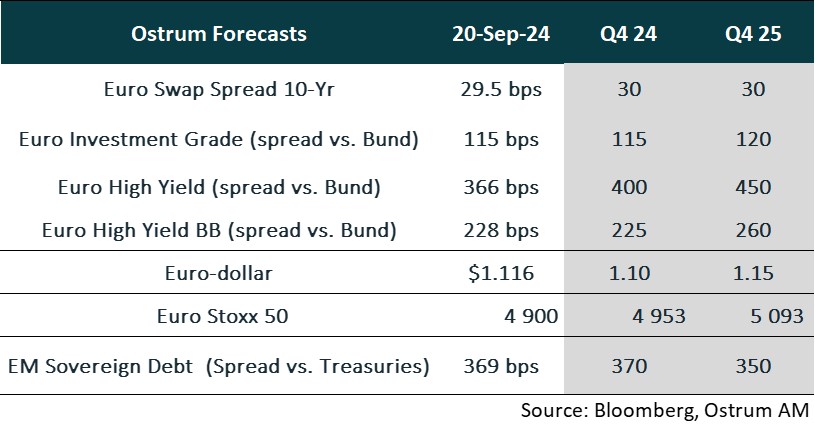

Market views

Asset classes

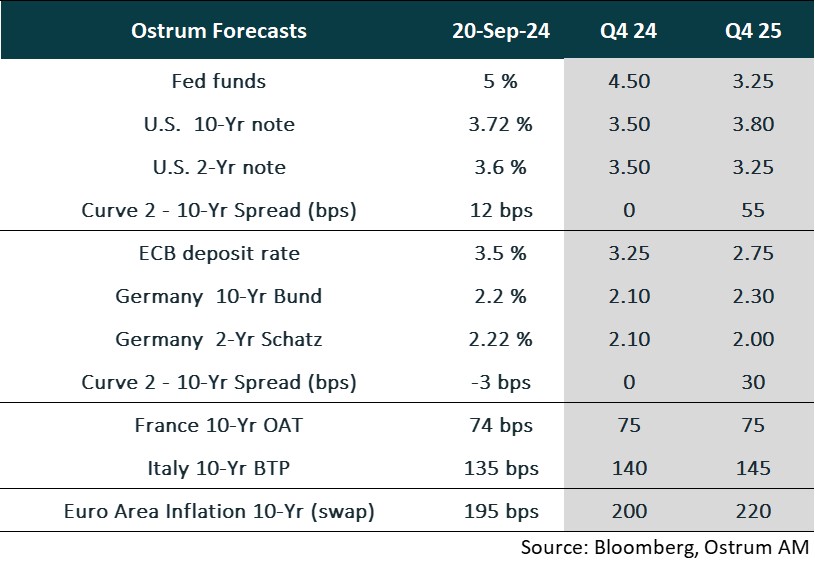

- U.S. Rates: The Federal Reserve has expedited its timeline for rate cuts, aiming to swiftly bring its rate closer to neutral. The 10-year Treasury yield is expected to converge around 3.50% before experiencing a slight uptick in 2025.

- European Rates: The German Bund is projected to follow the U.S. Treasury note, reaching approximately 2.10% by year-end. The steepening of the yield curve is likely to continue.

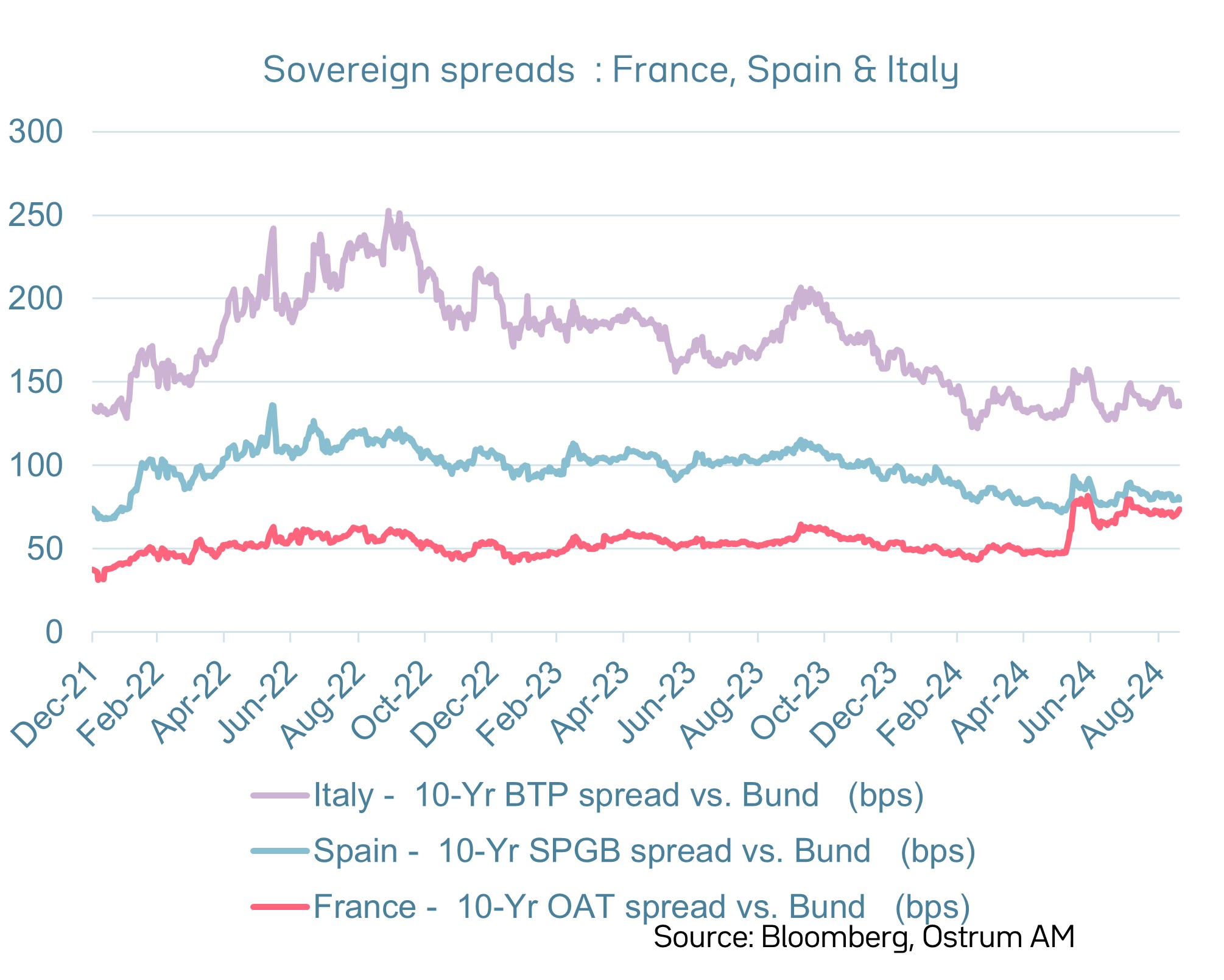

- Sovereign Spreads: Budgetary uncertainties will keep spreads elevated in France and Italy, reflecting ongoing fiscal challenges.

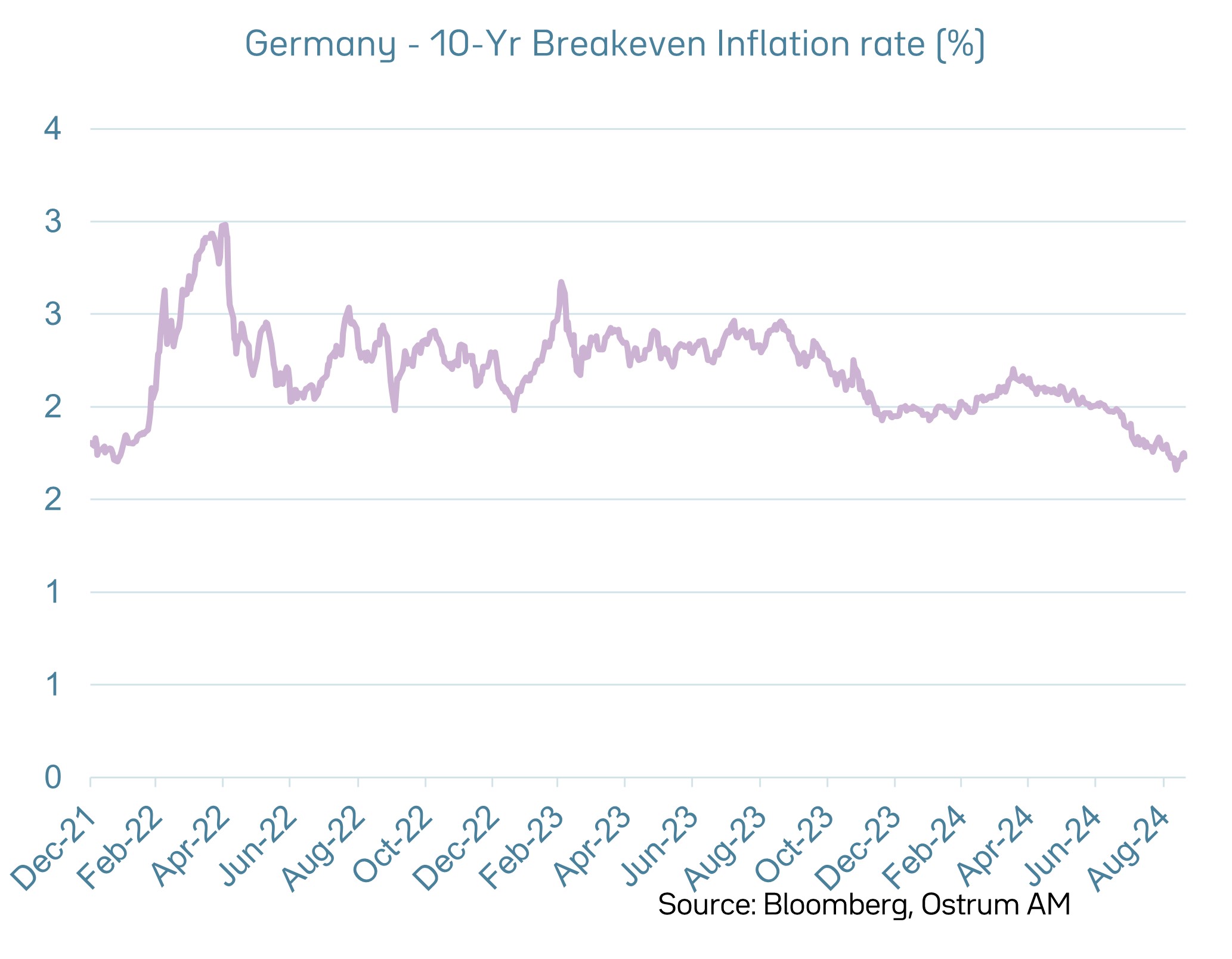

- Eurozone Inflation: Breakeven inflation rates remain largely stable, in line with the European Central Bank's target. However, a widening of these rates is anticipated amidst a backdrop of a steepening yield curve.

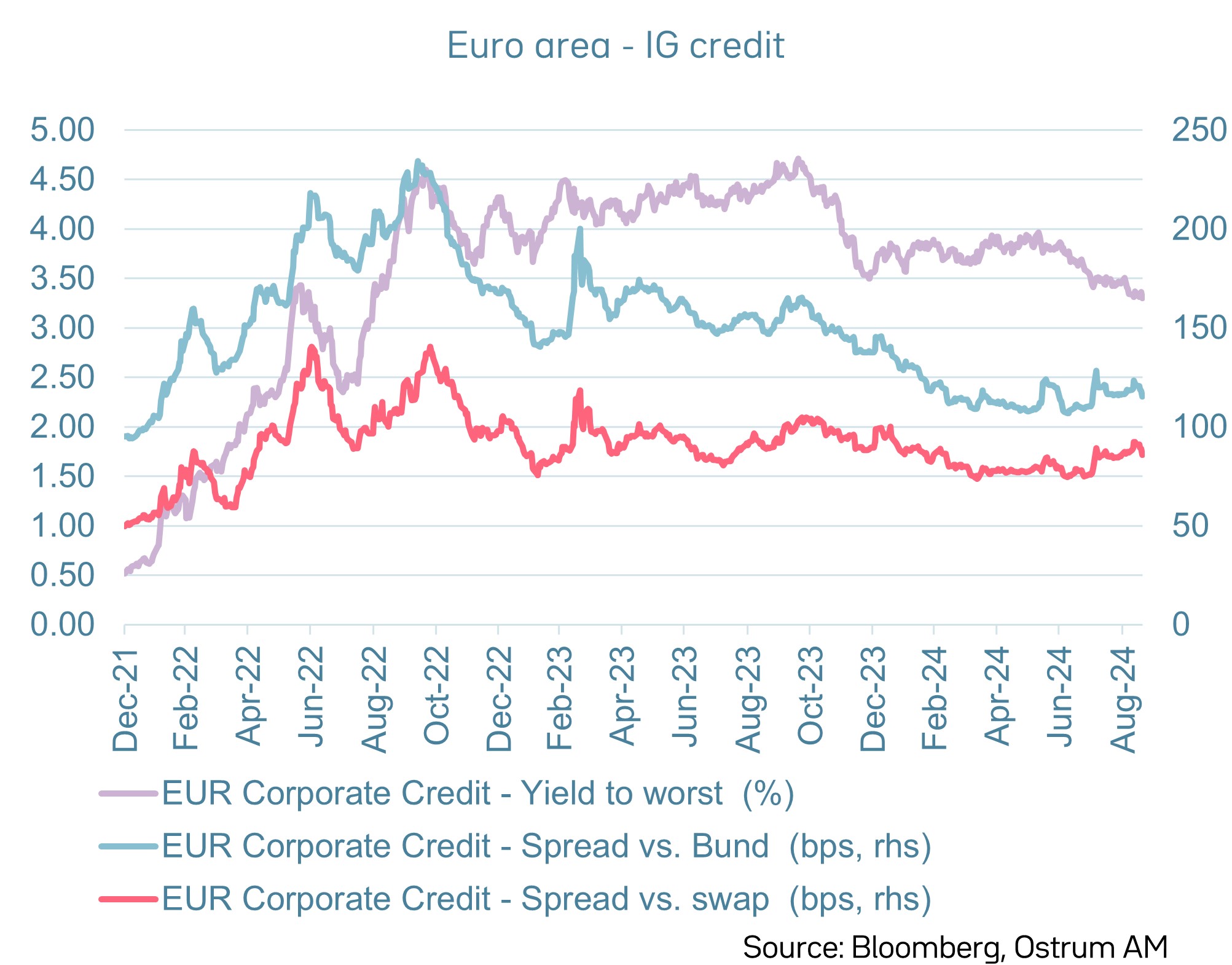

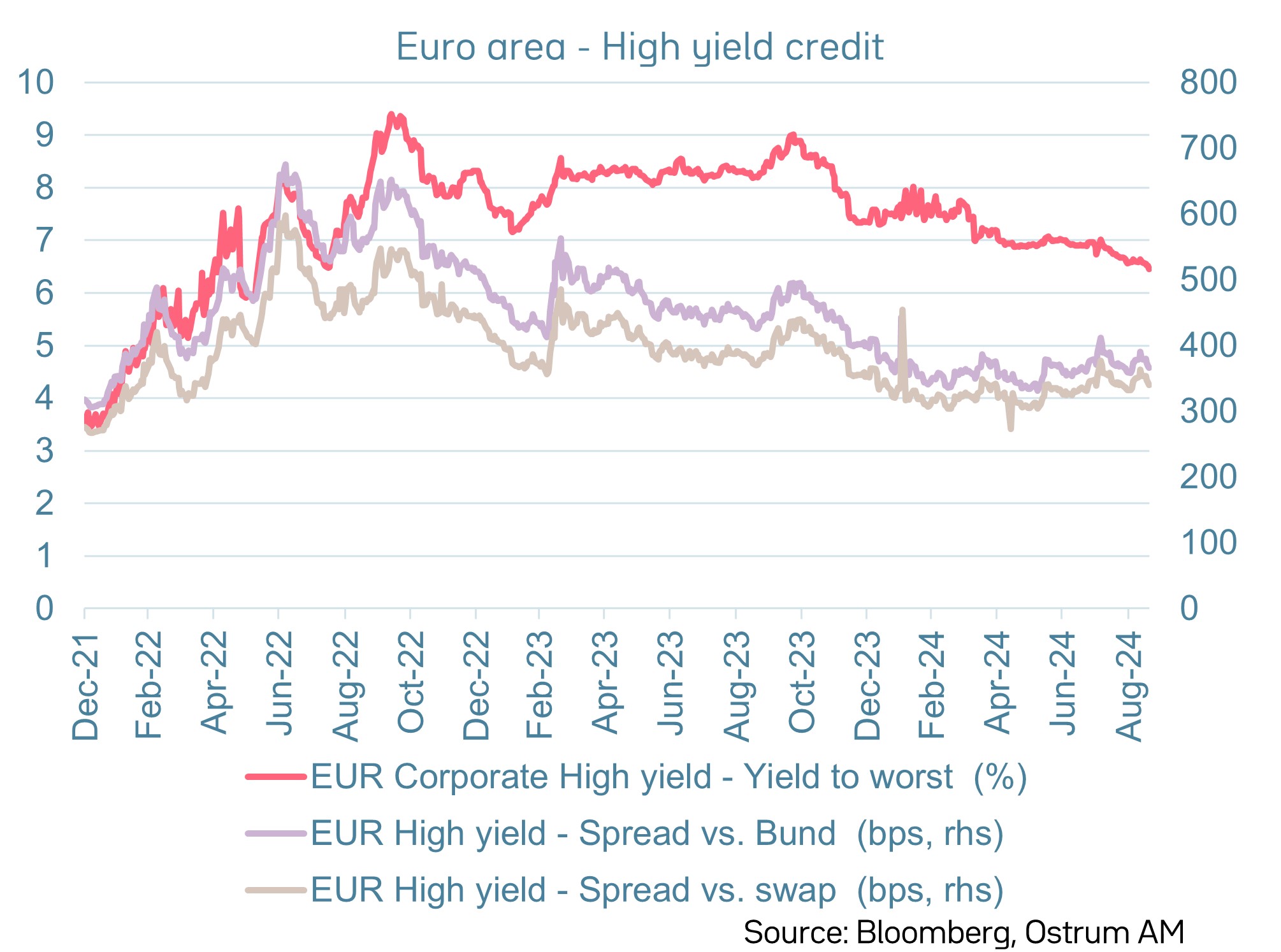

- Euro Credit: Spreads are expected to remain stable around 115 basis points over the Bund. High-yield valuations appear more stretched, with spreads likely to widen, particularly for ratings of B and below.

- Currency: The euro is benefiting from the Fed's rate cuts but is expected to remain stable through year-end before trending towards $1.15 by 2025.

- Equities: Modest sales growth is offset by high margins and rising multiples. An uptick in revenue growth is anticipated to enable the Euro Stoxx 50 index to resume its upward trajectory by 2025.

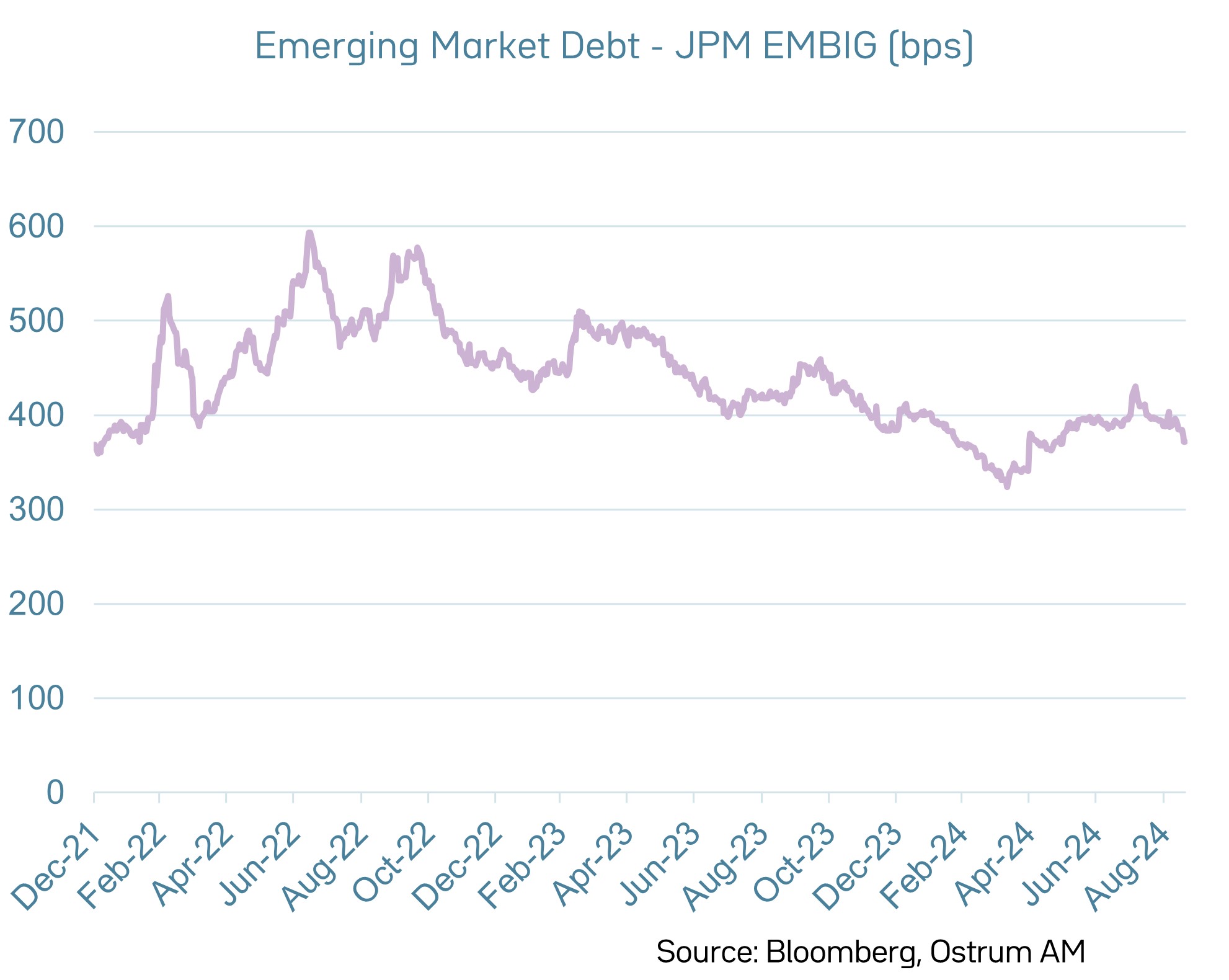

- Emerging Market Debt: Stability is projected through the end of the year, bolstered by the Fed's actions. A new tightening cycle could be on the horizon in 2025.

Market indicators

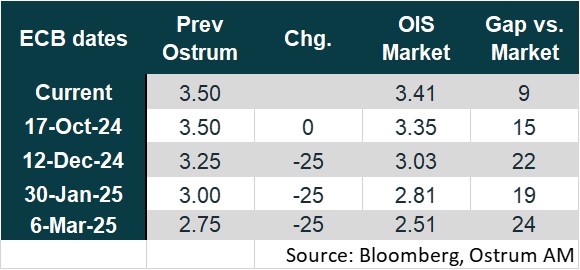

Central Banks : G4

Fed, ECB, BoE & BoJ

G4 Policy rates

Central Banks : ECB & FED

Ostrum Forecasts & Markets

Federal Reserve – Fed Funds rate

ECB – Deposit Facility rate

Fixed income markets : Euro area

Money market and bond market

Government bond yields & money rates

Yield curves : 2s10s & 10s30s spreads

Sovereign spreads & breakeven inflation rates

10-Yr sovereign spreads (vs. Bunds)

Breakeven inflation rates (Bundi)

Fixed income markets : United States

Money market and bond market & breakeven inflation rates

Government bond yields & money rates

Breakeven inflation rates (TIPS)

Credit markets : Euro area

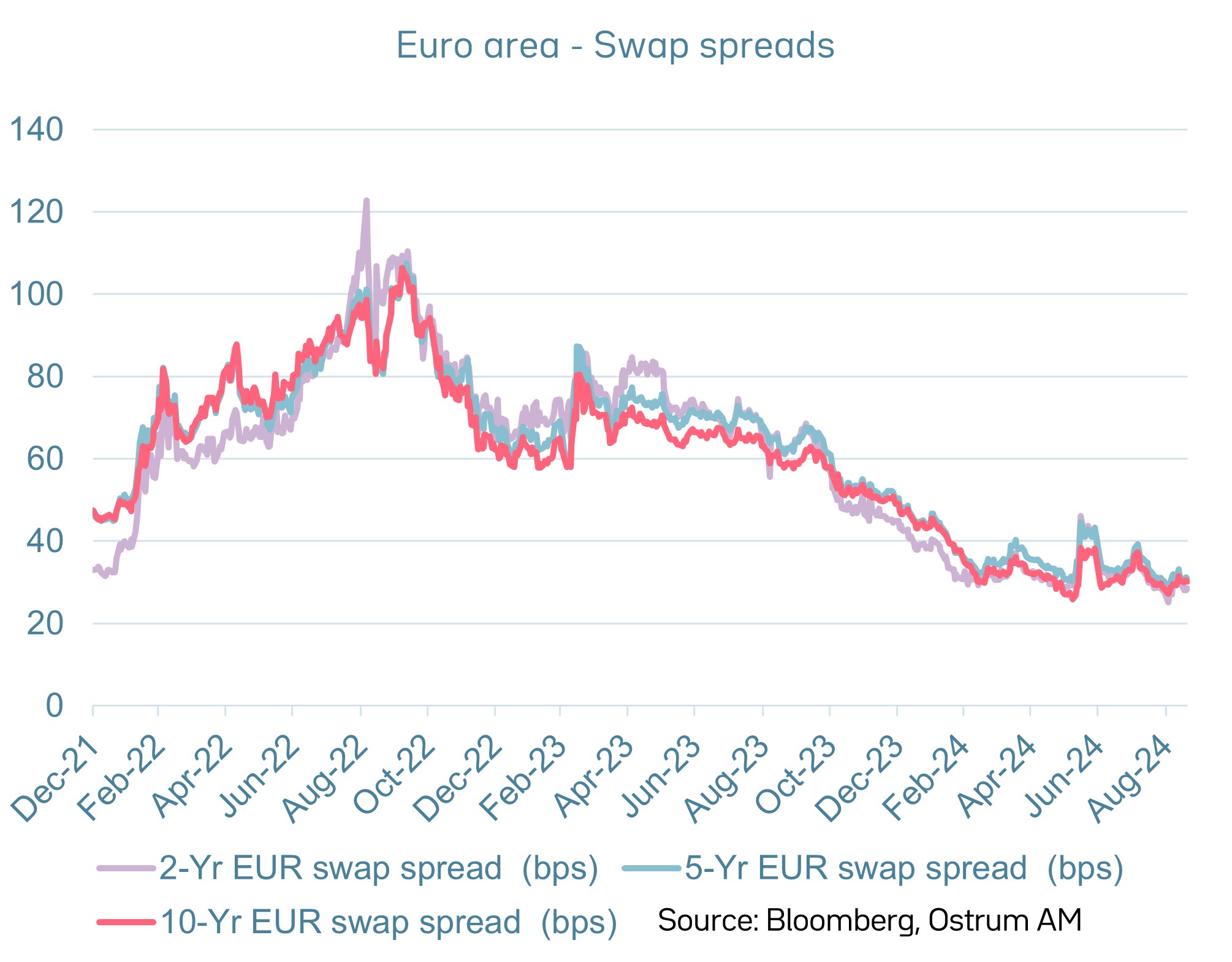

Swap spreads & investment grade corporate bond spreads

Swap spreads on German Bunds

Euro IG spreads

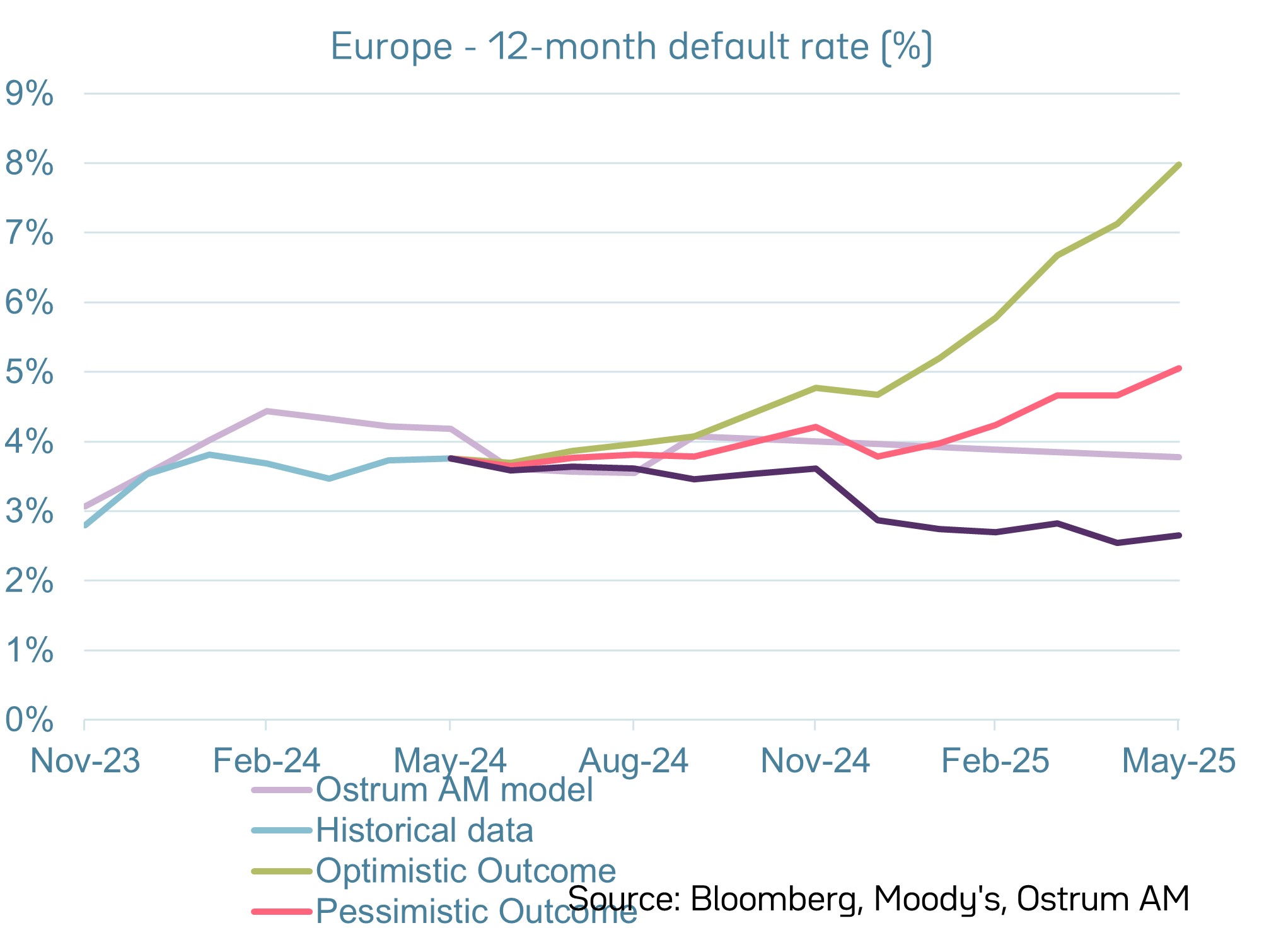

High yield markets : Euro area

High yield spreads & default rates

High yield credit spreads (speculative-grade)

Europe default rates (last twelve months)

Risky asset markets

Equity markets & emerging sovereign debt

Equity markets - S&P 500 & Euro Stoxx 50

Spreads on emerging market debt

Fixed income performances

Total return & yields

Total return & yield level