Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: New corporate pricing strategies vs. old inflation measures

- One of the key choices for central banks is the inflation reference. The Fed opted for the PCE deflator over the better-known CPI in 2012 when the FOMC defined its price stability objective as 2% inflation;

- PCE is more representative of what it is in the broader economy, whilst CPI is closer to out-of-pocket expenses;

- Measuring inflation is hard, and price indexes may not always fit the consumer experience with the evolution of the cost of living;.

- Furthermore, new corporate pricing strategies enabled by big data collection have resulted in personalized pricing that likely make overall inflation measurement more difficult;

- This could both complicate the conduct of monetary policy and explain the resilience in corporate margins as firms are better able to unveil consumers’ willingness to pay.

Market review: Fed : starting easy?

- The ECB cuts deposit rates by 25 bp as expected;

- The Fed will lower rates, with expectations of a 50 bp move rising towards the end of the week;

- Sovereign spreads tighten amid solid demand for 30-Yr Italian BTPs;

- World stocks rebound in the wake of US technology stocks.

Axel Botte's podcast

- Topic of the week: Fed 25 or 50 bps?, the ECB’s quantitative policy;

- Theme: High yield analysis elements.

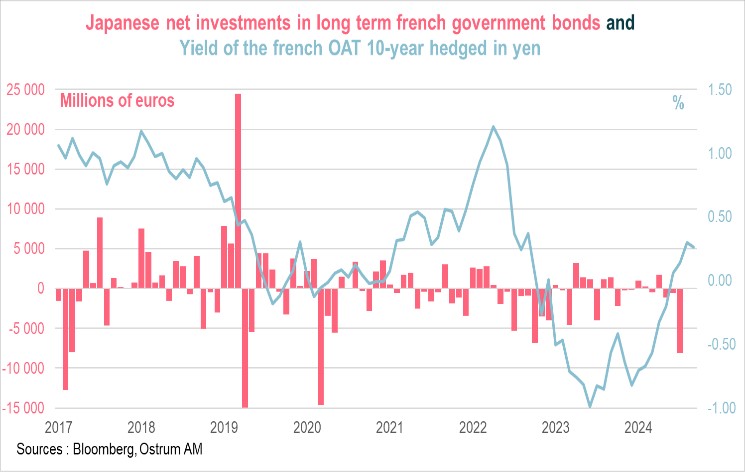

Chart of the week

Political turbulence in France has created some distrust abroad. Japanese investors, who had already reduced their presence in the French debt market over the past several years, sold the equivalent of 8 billion euros in July. Despite the tensions on the spread, the yield on the 10-year OAT hedged in yen for 12 months remains below the yield of the 10-year Japanese government bond (JGB) at 0.26% compared to 0.85%. The intervention of the European Central Bank (ECB) through the reinvestments of the PEPP (Pandemic Emergency Purchase Programme) has likely mitigated the selling pressure from Japan.

Figure of the week

63

China decided to raise the retirement age to 63 years for men from 60 years previously. Women’s retirement is also increased by 3 years to 58 years. The measure will take effect in January 2025, but will be implemented gradually.